Buffer Income ETFs are designed for investors looking for monthly income with a defined level of protection against losses. Most Buffer ETFs do not pay income to investors, so Buffer Income ETFs offer a solution by providing stable income. The high income, along with a defined level of downside protection, should appeal to income-oriented investors.

Why Buffer Income ETFs?

- Generate income with monthly distributions

- Defined rate of income over the outcome period

- Maintain built-in buffers to protect against initial losses

- Cost effective, flexible, liquid and transparent

- No bank credit risk

- Rebalance annually and can be held indefinitely

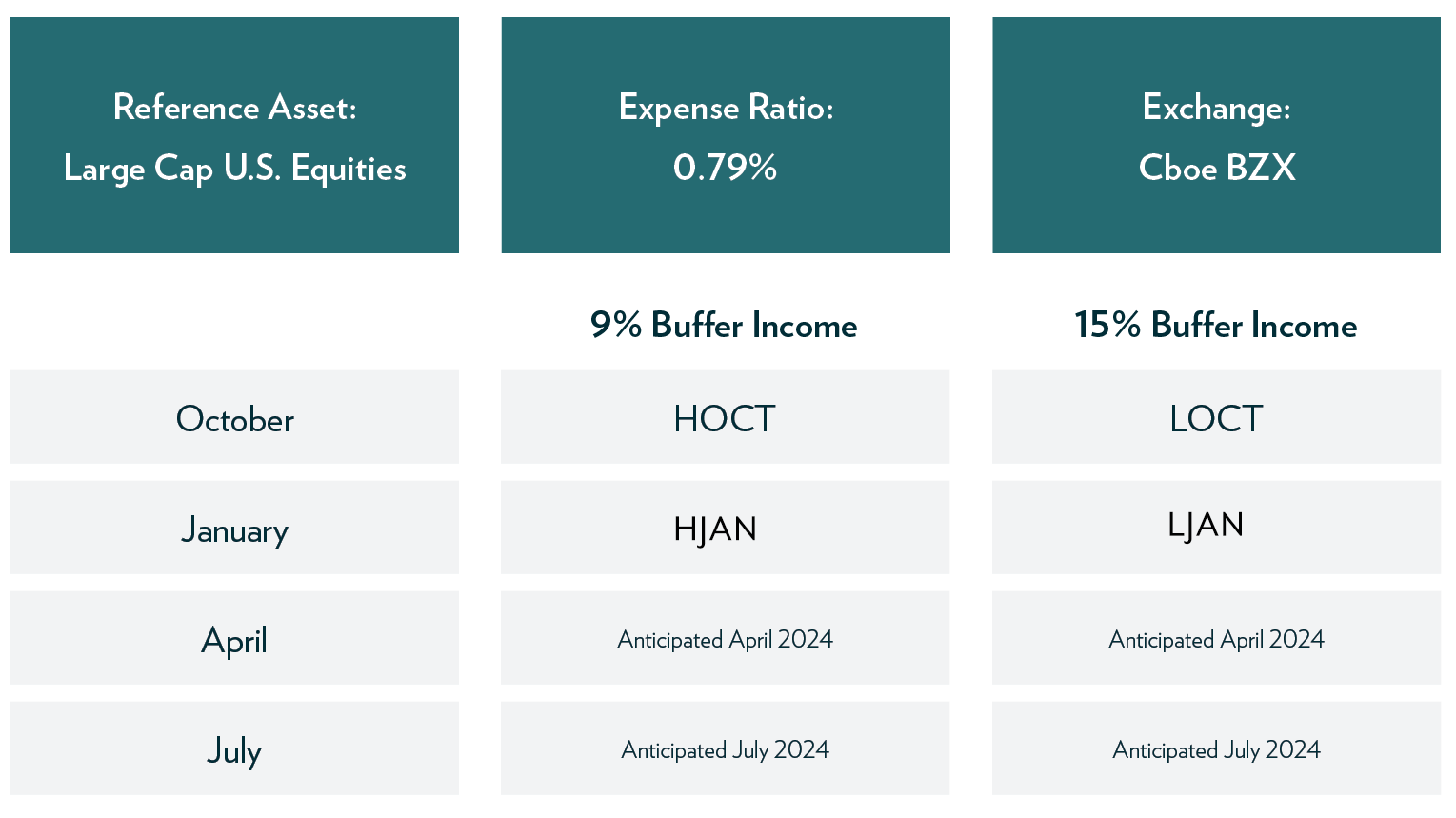

Innovator is currently in the middle of its launch of Buffer Income ETFs and there are two series available (October and January) that provide a 9% buffer and a 15% buffer. The annual expense ratios are 0.79%. More Buffer Income ETFs will be launched throughout 2024.

FT Vest U.S. Equity Buffer & Premium Income ETF

FT Vest has recently launched FT Vest U.S. Equity Buffer & Premium Income ETF – September (XISE), FT Vest U.S. Equity Buffer & Premium Income ETF – December (XIDE), and FT Vest U.S. Equity Buffer & Premium Income ETF – March (XIMR), that seek to produce a consistent level of income while providing a buffer against the first 10% loss of the reference asset (SPY). The annual expense ratio for these FT Vest ETFs is 0.85%.

Where do Buffer Income ETFs fit in a portfolio?

Buffer Income ETFs are designed to help diversify a fixed-income portfolio. Traditional fixed-income investments do not offer downside protection, so Buffer Income ETFs can provide some much-needed protection.

Buffer Income ETFs are designed to:

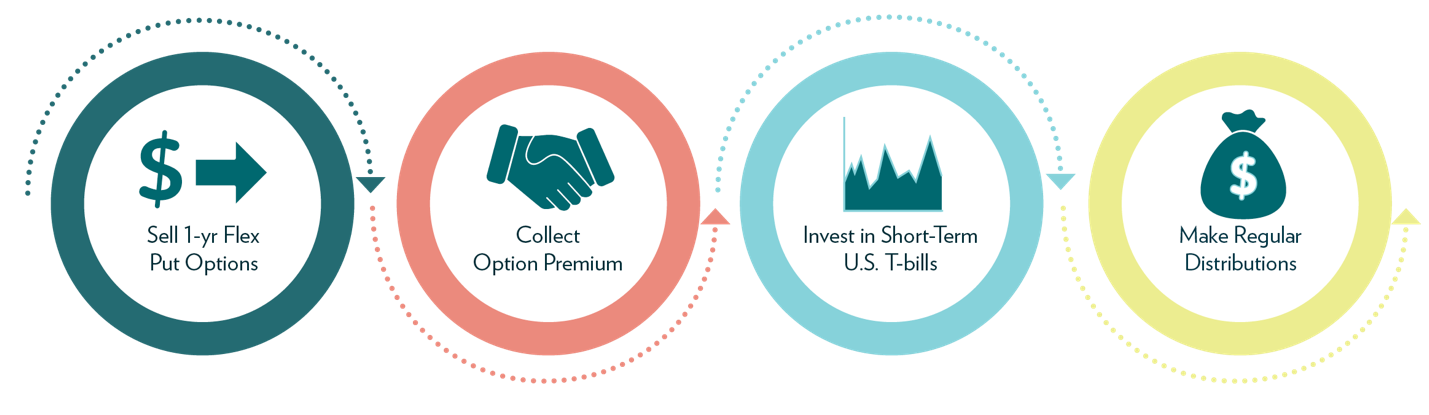

How do Buffer Income ETFs work?

Buffer Income ETFs use a combination of options and U.S. Treasuries to create their exposure. The result of the portfolio construction is a strategy that is engineered to generate meaningful income return potential in both positive and negative markets.

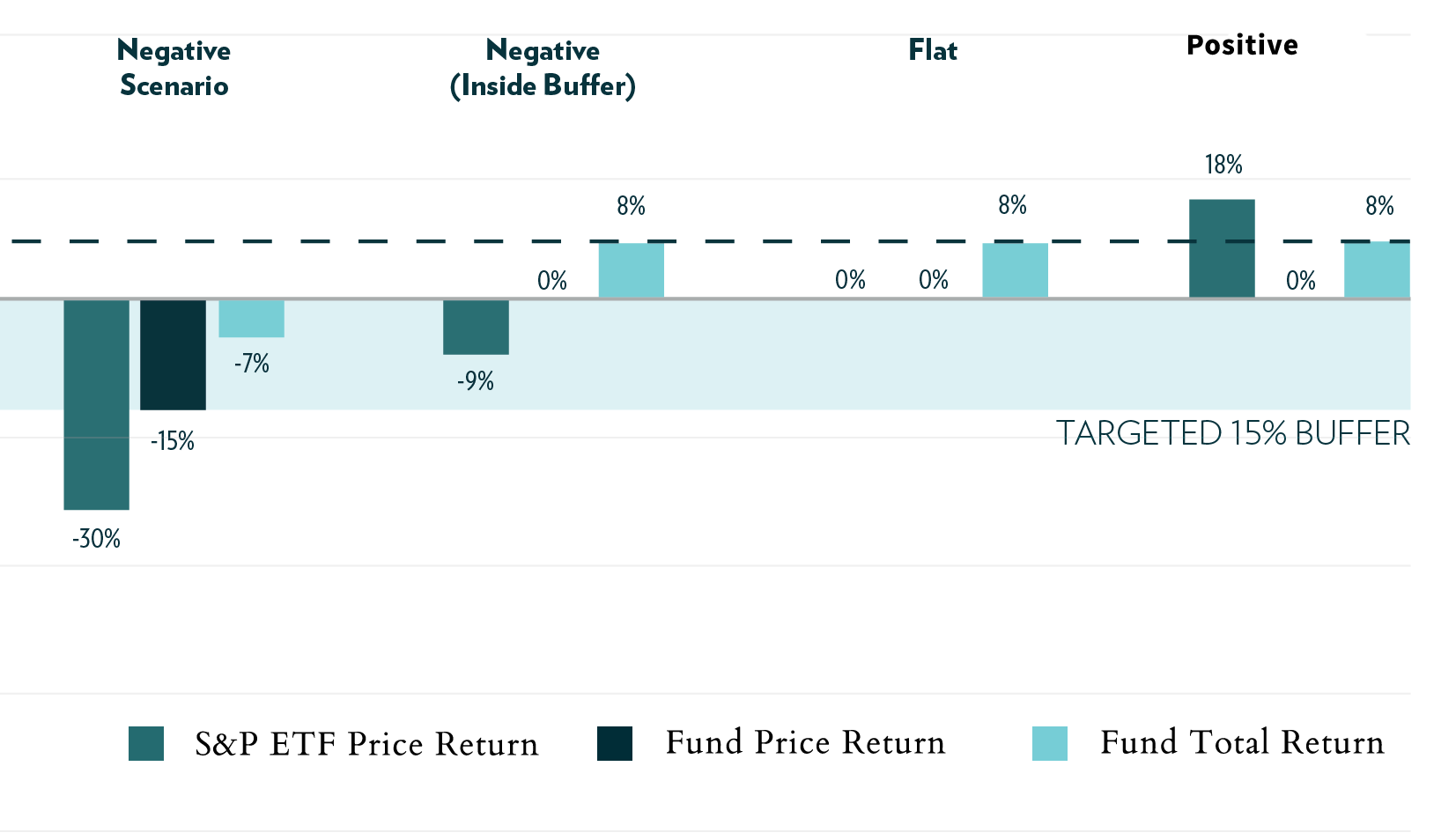

Hypothetical Outcome Period Returns: 15% Buffer, 8% Distribution Rate

The hypothetical chart uses a 15% buffer strategy as an example and assumes a distribution rate of 8% during the outcome period.

In a negative scenario, where the buffer level is breached, the investor will still receive the income payments, but the total return could be negative. For example, if the reference asset declines by 30%, the Buffer ETF would lose 15%. In this scenario, the total return would be -7% since the ETF provided income of 8% during the outcome period (-15% + 8% = -7%).

If the reference asset finishes the outcome period in negative territory, but inside the buffer, the investor’s return would equal the distribution rate of 8%. And, if the reference asset finishes the outcome period flat or positive, the investor’s return would also be equal to the distribution rate of 8%.

What are the building blocks of Buffer Income ETFs?

How do Buffer Income ETFs generate income?

Buffer Income ETFs generate high relative rates of income through a combination of option premiums and U.S. Treasury bills.

- Sell a one-year FLEX put option

- Collect the option premium

- Invest in short-term U.S. Treasury bills

- Make monthly distributions to investors

The final distribution of each outcome period is made the same day the ETF resets its distribution rate and buffer.

The final distribution of each outcome period is made the same day the ETF resets its distribution rate and buffer.

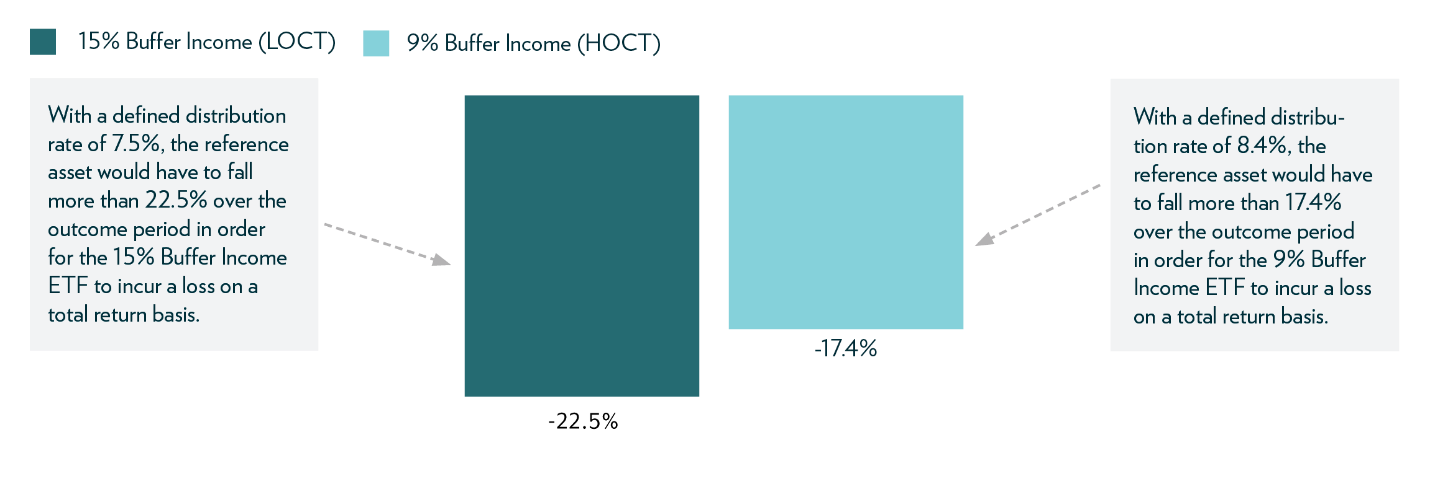

What is the break-even point for a Buffer Income ETF?

The break-even point is the level at which over a full 12-month outcome period a Buffer Income ETF will start to show losses on a total return basis. The chart shows hypothetical break-even scenarios for a 9% and 15% Buffer Income ETF.

Hypothetical Break-Even Point: 15% Buffer, 7.5% Distribution Rate

A 15% Buffer Income ETF, with a distribution rate of 7.5%, would start to show a loss, on a total return basis, if the reference asset falls more than 22.5% at the end of the outcome period.

Hypothetical Break-Even Point: 9% Buffer, 8.4% Distribution Rate

A 9% Buffer Income ETF, with a distribution rate of 8.4%, would start to show a loss, on a total return basis, if the reference asset falls more than 17.4% at the end of the outcome period.

Buffer Income ETFs have many advantages over traditional income strategies and generally offer very competitive distribution rates, with a moderate level of downside protection. These ETFs should be considered by any investor in need of a consistent income stream.

Stocks tend to outperform Bonds over long time horizons, but with significantly higher volatility. The current outlook for both stocks and bonds going forward appears less promising due to relatively low bond yields and elevated equity valuations. Still, many investors continue to increase their exposure to stocks to make up for what have been historically low bond yields. Buffer Income ETFs offer an alternative with a built-in level of downside protection. Buffer Income ETFs also have the potential to provide higher income than bonds, and with lower volatility than an unhedged stock portfolio. They provide a fixed level of monthly income, regardless of the performance of the reference asset (SPY) during the 12-month outcome period. The downside protection is for the first 9%, 10%, or 15% loss of the reference asset, depending on the Buffer Income ETF series.

While investors have typically incorporated bonds in a portfolio to reduce volatility, they had a rude awakening in 2022 when both stocks and bonds tumbled. U.S. 10-Year Treasury bonds lost 17.8% and BBB corporate bonds dropped 15.14% in 2022. The S&P 500 declined 18.04% (including dividends). It was a particularly miserable year for investors who thought their bond holdings would cushion their declining stock portfolios.

How can investors potentially increase their return potential without interest-rate risk in a bond portfolio?

Let’s consider the use of Innovator’s October 2023 Premium Buffer Income ETFs as a bond replacement. Again, these two Buffer Income ETFs pay fixed monthly income while also providing some downside protection.

October 2023 Premium Buffer Income ETFs:

HOCT: Premium Income 9 Buffer: 7.64% net income

LOCT: Premium Income 15 Buffer: 6.67% net income

Here are 4 scenarios where investors can incorporate Buffer Income ETFs as a defensive, equity-based alternative to bonds:

Scenario 1: 60/20/20

Potential allocation: 60% Equities, 20% Buffer Income ETFs, 20% Bonds

An investor is concerned about rising interest rates and wants to underweight bonds. Rather than increase the portfolio’s allocation in unhedged equities, the investor can incorporate a Buffer Income ETF, which can provide a high level of income without interest-rate risk. Depending on the level of downside protection desired, the investor could choose either the Income 9 Buffer or the Income 15 Buffer. The “15” pays about 1% less income than the “9” annually, but provides more downside protection.

Scenario 2: 60/30/10

Potential allocation: 60% Equities, 30% Buffer Income ETFs, 10% Bonds

An investor is concerned about having a portfolio of low-yielding bonds since they will not provide enough income to offset living expenses. To increase income, the investor could incorporate Buffer Income ETFs to replace most of the bond portfolio.

Scenario 3: 50/25/25

Potential allocation: 50% Equities, 25% Buffer Income ETFs, 25% Bonds

An investor began the year with a balanced 60/40 portfolio, but high stock performance during the year has pushed the stock allocation up to 65% and the bond allocation down to 35%. Concerned about high equity valuations and low bond yields, the investor would like to reduce the unhedged equity allocation and also reduce the exposure to bonds. By incorporating Buffer Income ETFs in the portfolio, the investor can generate more income while reducing the unhedged exposure to stocks and bonds.

Scenario 4: 35/35/30

Potential allocation: 35% Equities, 35% Buffer Income ETFs, 30% Treasury Bills

An investor has a balanced 50/50 portfolio, but fears the stock market is nearing bubble territory as valuations are at all-time highs. In addition, bond yields are too low to provide the investor with the income stream required. The investor would like to protect against a potential decline in the stock market and also reduce interest rate risk in the bond portfolio. By incorporating Buffer Income ETFs and 3-month U.S. Treasury bills in the portfolio, the investor can greatly reduce the unhedged equity exposure and eliminate interest rate risk by swapping out of bonds and into short-term Treasury bills and Buffer Income ETFs.

Summary: For over a decade, investors have enjoyed strong returns from a traditional 60/40 portfolio, but the next decade may be quite different from the previous one. We still have historically low bond yields and relatively high inflation, which both pose threats to bondholders. While there are many alternative investments to choose from, very few offer both downside protection and a high level of income. With lower returns possibly on the horizon for a traditional 60/40 portfolio, Buffer Income ETFs offer a potential solution for investors looking for alternatives to bonds.

Barrier Income ETFs are designed for investors looking for a high level of quarterly income with downside risk management. Most Buffer ETFs do not pay income to investors, so Barrier Income ETFs offer a solution by providing stable income. The high income, along with a built-in downside barrier to protect against losses, should appeal to income-oriented investors. Note, it’s important to understand that Barrier Income ETF shareholders are subject to all losses if the underlying asset experiences a loss that exceeds the barrier level at the end of the outcome period.

What Barrier Income ETFs are available?

Innovator has four series available, January, April, July, and October. And, there are four barrier levels to choose from, 10%, 20%, 30%, and 40%. The annual expense ratio is 0.79% and the reference asset is the SPDR S&P 500 ETF Trust (SPY).

Why Barrier Income ETFs?

- High level of income

- Defined rate of income over the outcome period

- Built-in risk management

- Four barrier levels to choose from depending on your risk profile

- Cost effective, flexible, liquid and transparent

- No bank credit risk

- Rebalance annually and can be held indefinitely

How do Barrier Income ETFs work?

Barrier Income ETFs pursue a high level of income by selling options on the SPDR S&P 500 ETF Trust (SPY). The result is a strategy that seeks to offer meaningful return potential in both positive and negative markets.

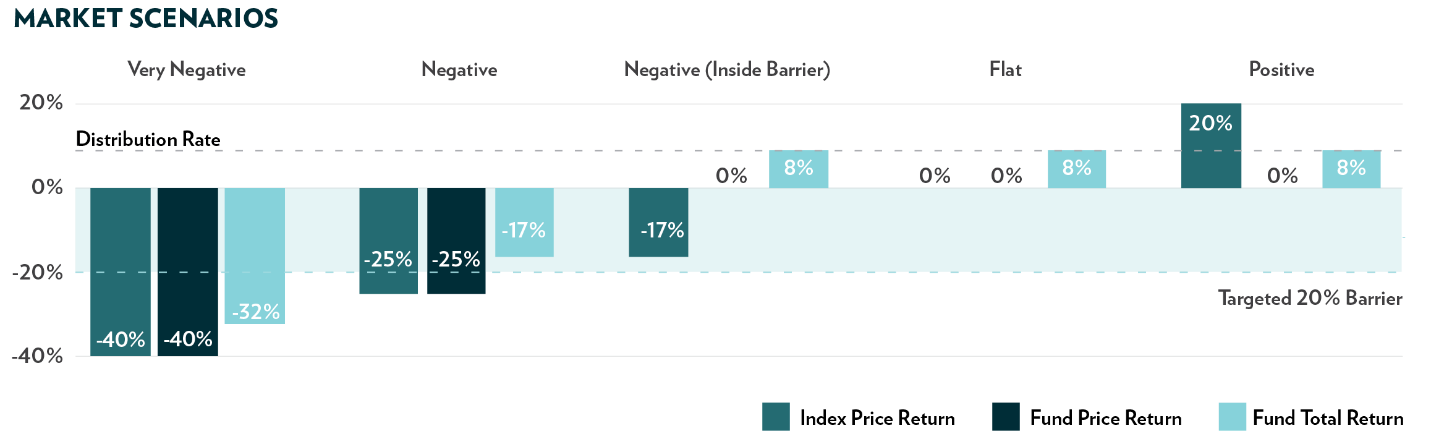

Understanding your experience with Barrier Income ETFs

Potential Outcome Scenarios

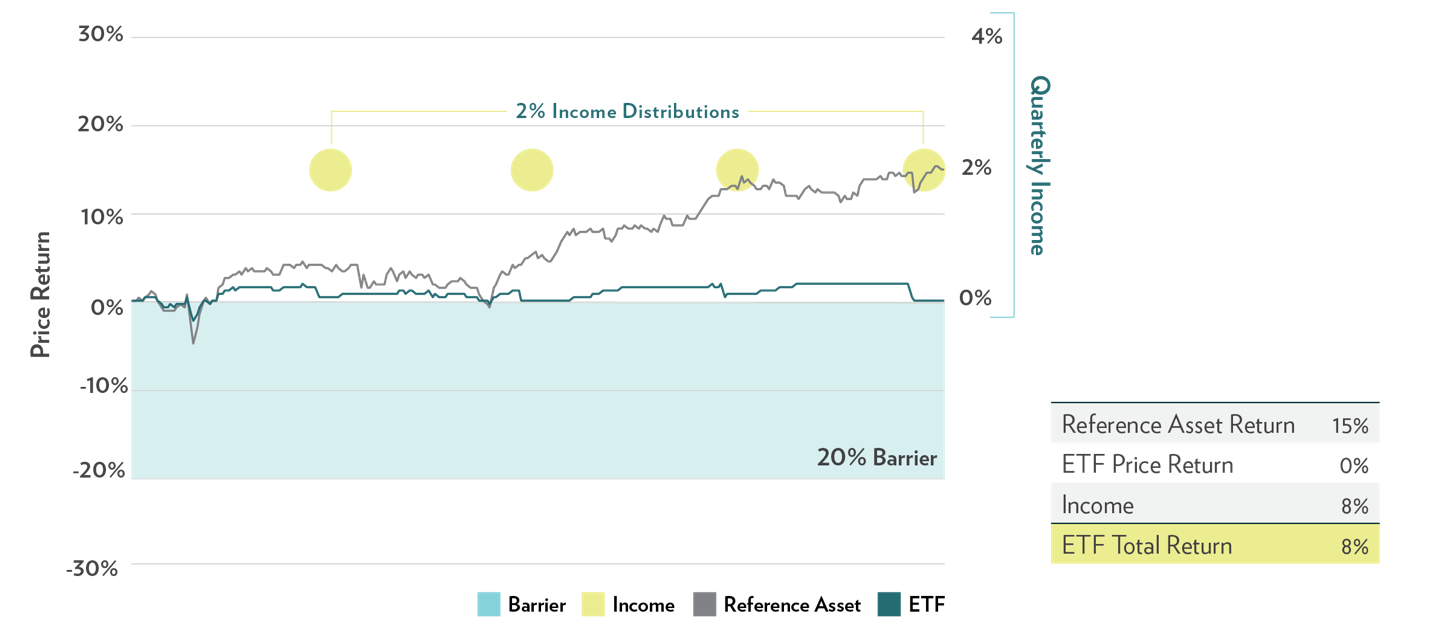

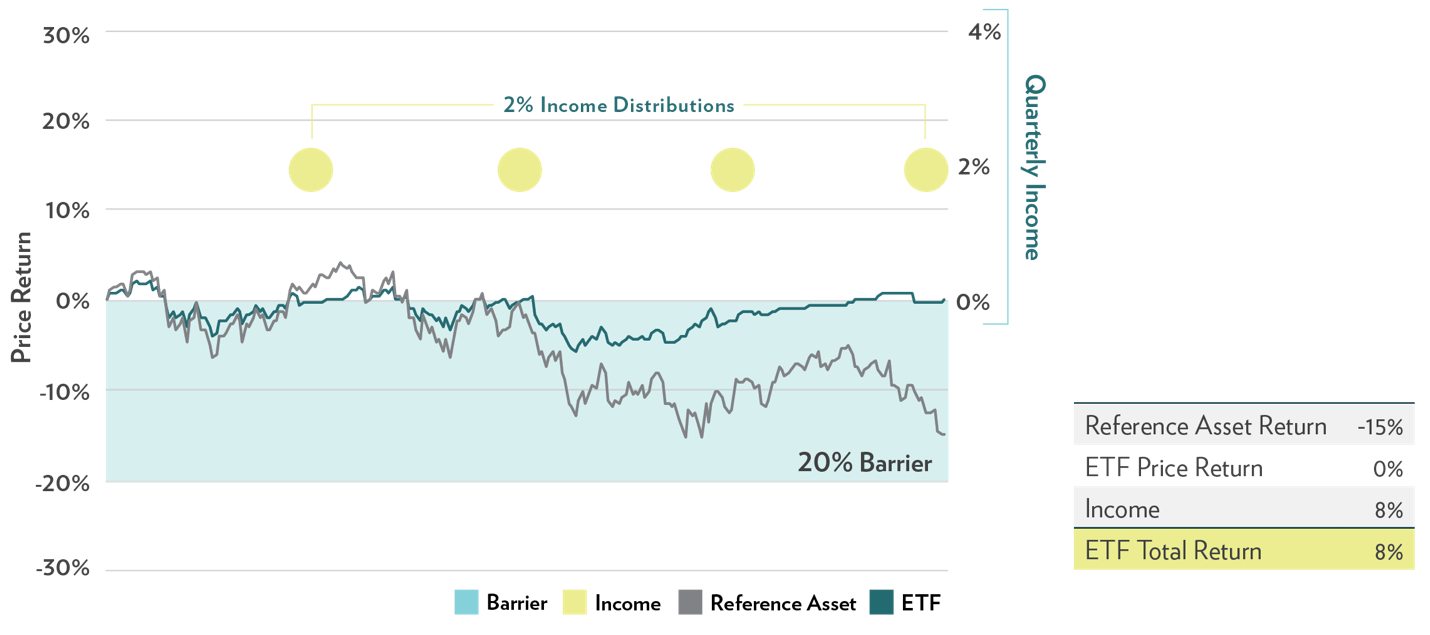

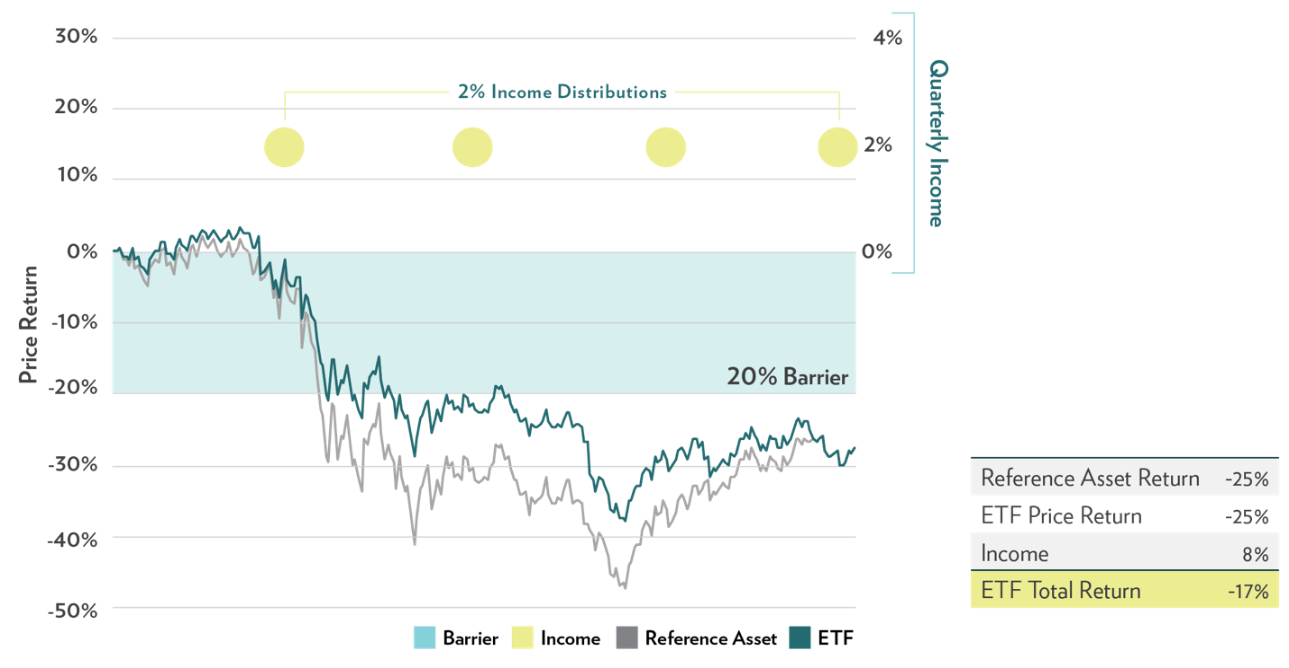

Selling options creates exposure to the index at levels below the chosen barrier, over the full outcome period. The hypothetical chart uses a 20% barrier as an example of what investors can expect across different market return scenarios. The annual distribution rate is 8% (quarterly payments).

Scenario 1: Reference asset increases

As the market trades up, the ETF remains near its starting price. At the end of the outcome period, the NAV of the ETF equals the NAV from day one. The investor receives all four income distributions.

Scenario 2: Reference asset decreases, but finishes above the barrier level

As the market trades down, the ETF declines to a lesser extent. At the end of the outcome period, the NAV of the ETF equals the NAV from day one. The investor receives all four income distributions.

Scenario 3: Reference asset decreases and finishes below the barrier level

As the market trades down, the ETF also declines. Since the reference asset breached the 20% barrier level at the end of the outcome period, the ETF price return matches the performance of the reference asset, -25%. The investor receives all four income distributions (8%) for a total return of -17%.

The Barrier ETF distribution rate, established at the commencement of each outcome period, is an annualized payment rate that is achievable through the premium received from sold option contracts (as described further below) and the fund’s investments in U.S. Treasuries. The distribution rate is not guaranteed.

The funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the fund is right for you, please see “Investor Suitability” in the prospectus.

The defined distribution rate is shown prior to taking into account fees charged to shareholders, which have the result of a lower distribution. The funds differ from other funds that utilize a defined outcome investment strategy. The funds do not provide a buffer against all underlying ETF losses or a floor that provides a maximum amount of underlying ETF losses. As a result, an investor can lose the entire investment prior to consideration of any defined distribution payments.

In this section let’s compare various Barrier and Buffer Income ETF return scenarios. We’ll look at hypothetical examples of the reference asset finishing inside, below, and above the barrier or buffer level to illustrate the return differences. We’ll assume a 15% Barrier, 15% Buffer, with a 7% distribution rate. We’ll also assume annual dividend income equal to 1.7% for the S&P 500.

Scenario 1: S&P 500 finishes inside the buffer and barrier: 15% Buffer vs. 15% Barrier, 7% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | -10% | 1.7% | -8.3% |

| Barrier Income ETF | 0% | 7% | 7% |

| Buffer Income ETF | 0% | 7% | 7% |

Scenario 2: S&P 500 finishes below the buffer and barrier: 15% Buffer vs. 15% Barrier, 7% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | -20% | 1.7% | -18.3% |

| Barrier Income ETF | -20% | 7% | -13% |

| Buffer Income ETF | -5% | 7% | 2% |

Scenario 3: S&P 500 finishes above the buffer and barrier: 15% Buffer vs. 15% Barrier, 7% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | 15% | 1.7% | 16.7% |

| Barrier Income ETF | 0% | 7% | 7% |

| Buffer Income ETF | 0% | 7% | 7% |

Let’s look at more hypothetical examples of the reference asset finishing inside, below, and above the barrier or buffer level to illustrate the return differences. We’ll assume a 10% Barrier, 10% Buffer, with a 6% distribution rate.

Scenario 1: S&P 500 finishes inside the buffer and barrier: 10% buffer vs. 10% barrier, 6% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | -5% | 1.7% | -3.3% |

| Barrier Income ETF | 0% | 6% | 6% |

| Buffer Income ETF | 0% | 6% | 6% |

Scenario 2: S&P 500 finishes below the buffer and barrier: 10% buffer vs. 10% barrier, 6% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | -20% | 1.7% | -18.3% |

| Barrier Income ETF | -20% | 6% | -14% |

| Buffer Income ETF | -10% | 6% | -4% |

Scenario 3: S&P 500 finishes above the buffer and barrier: 10% buffer vs. 10% barrier, 6% distribution rate

| Scenario Recap | Price Return | Income Return | Total Return |

| S&P 500 | 15% | 1.7% | 16.7% |

| Barrier Income ETF | 0% | 6% | 6% |

| Buffer Income ETF | 0% | 6% | 6% |

The hypothetical graphical illustrations provided are designed to illustrate the outcomes based on hypothetical performances of the underlying ETFs if a shareholder holds the ETF shares for the entirety of the outcome period. There is no guarantee that an ETF will be successful in its attempt to provide the outcomes. The tables do not represent all market scenarios or actual buffer or barrier levels that are available in the ETF marketplace. The returns ETFs seek to provide do not include the costs associated with purchasing shares of the ETF and certain expenses incurred by the ETF.

What are Barrier Income ETFs?

Barrier Income ETFs seek to provide a level of income and a barrier against losses, known to investors before they invest. The ETFs offer exposure to an underlying reference asset, over a 12-month outcome period, with a defined level of income and a downside barrier. Note, if an investor purchases an ETF after the outcome period has begun, or sells shares prior to the end of the outcome period, the investment return will differ from the ETFs defined return parameters.

What is a barrier?

Barrier refers to a payoff profile that depends on whether or not the underlying index breaches a predetermined performance level. For example, a 20% Barrier seeks to prevent losses down to the 20% level. However, if the Barrier level is breached at the conclusion of the outcome period, the price of the ETF is designed to match the performance of the reference asset. The ETF will still seek to provide income equal to its stated distribution rate.

How do the Barrier Income ETFs generate income?

Each Innovator Barrier ETF holds a customized basket of FLexible EXchange options (FLEX options) with varying strike prices (the price at which the option purchaser may buy or sell the security at the expiration date), and the same expiration of approximately one year. The ETF also holds U.S. Treasuries with maturities up to one year. This contributes to each ETF’s defined level of income.

When are the income payments made?

On the first day of the outcome period the defined distribution rate is set. The defined distribution rate is paid quarterly and in equal amounts. The pay dates correspond with the start of calendar quarters.

How do the distributions work?

Distributions follow a schedule that includes an ex-date, record date and payment date.

The ex-date is a cutoff date when new owners of the ETF are no longer entitled to the upcoming income distribution. At market open on the ex-date, the NAV of the ETF will drop by the amount of the upcoming distribution. The ex-date is the second-to-last trading day of each quarter.

The record date is the last trading day of the quarter. Owners of the ETF on the record date will receive a payment on the payment date.

The payment date is the first trading day of the next quarter. For example, the schedule for the first distribution from the April series is as follows:

Ex-date: 6/29/2023

Record date: 6/30/2023

Payment date: 7/3/2023

Do investors still receive income if the index finishes below the barrier level?

Yes. A level of income will be stated at the start of each outcome period. The ETF is designed to pay the income whether the reference asset finishes above or below the barrier level. There is no guarantee the fund will be successful in its attempt to provide the outcomes.

What if the barrier level is breached in the middle of the outcome period?

The NAV of the barrier will fluctuate throughout the outcome period. The ETF can potentially trade down if the index declines, particularly as it approaches the barrier level. However, a barrier “breach” only occurs if the index is below the barrier level at the close of the final day of the outcome period.

What if I buy shares of a Barrier Income ETF intra-outcome period (before or after the reset date)?

A Barrier ETF seeks to provide a defined outcome, regardless of the purchase date. Visit Innovator’s Potential Outcome Analyzer tool to view the current defined outcome parameters for any of their ETFs: www.innovatoretfs.com.

Investors purchasing shares of an ETF before or after its launch date will receive a different payoff profile than those who entered on day one.

Because the NAV of the fund will fluctuate throughout the course of the outcome period, investors can potentially purchase shares of a Barrier ETF opportunistically. For example, if the reference asset and Barrier ETF both decline in the outcome period, an investor could purchase shares of the ETF and achieve capital appreciation in addition to the ETF’s income. However, there are potential risks associated with purchasing the ETFs in the middle of an outcome period.

In addition, investors purchasing shares following a distribution date will not be entitled to defined distributions made prior to the distribution date and will therefore not receive the full defined distribution rate for such outcome period. Similarly, investors selling shares prior to a distribution date will not receive the full defined distribution rate for the outcome period and will not be entitled to defined distributions after a sale.

Do Barrier Income ETFs mature?

No. Upon the conclusion of the outcome period, the ETF will reset into a new portfolio with the same exposure, barrier level, and term, and a new defined distribution rate will be determined.

What is the annual expense ratio?

The expense ratio is 0.79%.

Does any entity guarantee I will not lose money?

No. Unlike certain insurance products and structured products, ETFs are not backed by the faith and credit of an issuing institution like an insurance company or a bank. This also means that Barrier Income ETFs are not exposed to bank credit risk. The options held by the ETFs are guaranteed for settlement by the Options Clearing Corporation (OCC). In the unlikely event the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the ETFs could suffer significant losses.

Can investors buy and hold Barrier Income ETFs or do they need to be repurchased at the end of each outcome period?

Barrier ETFs reset at the conclusion of their respective outcome periods, but may be held indefinitely. At the end of the outcome period, each ETF will roll into a new set of option contracts and U.S. Treasuries with the same exposure, barrier level, and term length, and a new defined distribution rate will be determined.

Where can Barrier Income ETFs fit in a portfolio?

Barrier Income ETFs provide high income potential, built-in risk management, and low interest-rate risk, and could make a meaningful and diversifying return contribution to a portfolio’s fixed income allocation. Additionally, Barrier Income ETFs don’t carry bank credit risk, potentially helping to further diversify a portfolio’s bond allocation.