img-buffer-etfs1-4

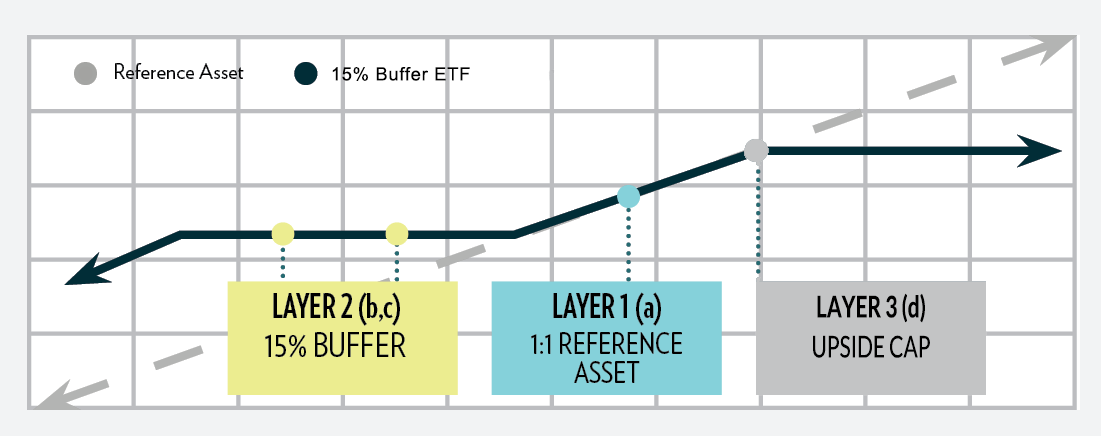

img-buffer-etfs1-4Buffer ETFs are created with a package of FLexible EXchange (FLEX) options – a type of option that allows customized strike prices, underlying reference assets, and expiration dates. Specifically, the ETFs consist of a basket of FLEX options with strike prices expiring on a designated date, forming an outcome period. The options work together to generate the reference asset exposure, buffer, and upside cap.

While the package’s options are all established at the same time, it can be helpful to visualize them as different layers. Using a Buffer ETF with 15% downside protection as an example, the charts in this chapter illustrate how each layer contributes to the construction of the defined outcome.

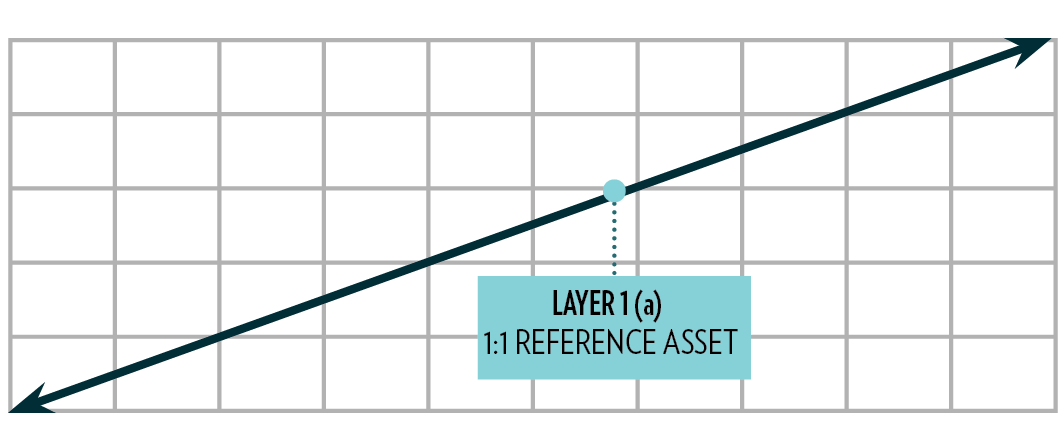

Layer 1 (a): Reference Asset Participation

The first layer involves buying a call option on the reference asset. This provides synthetic 1:1 exposure to the index. A synthetic investment is designed to replicate the return of a selected index (e.g., S&P 500, Nasdaq-100).

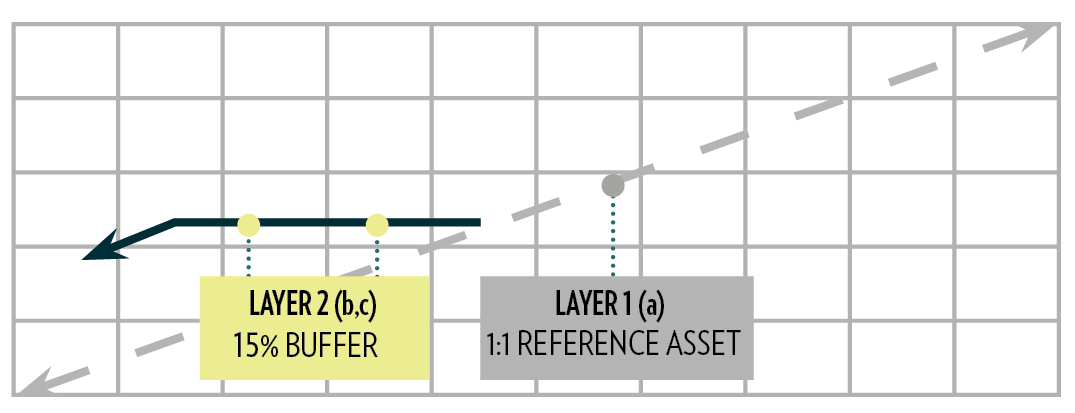

Layer 2 (b, c): Downside Buffer

The second layer incorporates a put spread. Together, the long and short put produce the downside buffer of 15%.

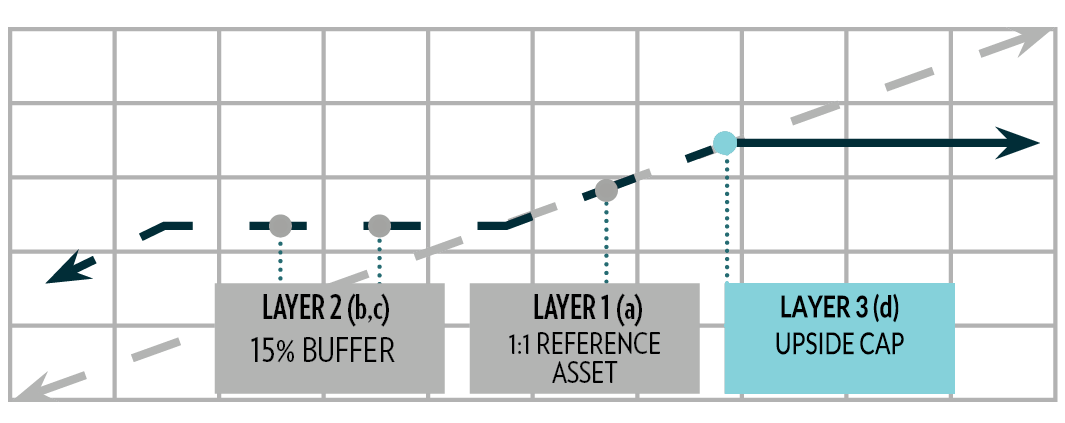

Layer 3 (d): Upside Cap

The third layer involves selling a call option to generate enough premium to cover the cost of the buffer. The sale of this call option creates the upside cap.

Resulting Payoff

The result is a reshaped return profile relative to the reference asset.

Buffer ETFs seek to offer many benefits, helping investors narrow the range of potential outcomes and enter equity markets with greater confidence. However, given the large number of ETFs available, it can be challenging to determine where to begin and how to implement a Buffer ETF portfolio.

Here are three common ways Buffer ETFs are being utilized by investors:

Option 1: Static Strategy

Buy a single Buffer ETF at the start of its outcome period and hold through the entire outcome period to realize the defined outcome.

Potential benefits:

• Full starting outcome parameters are known

• Potentially achieve a defined outcome

• Simplicity

Example:

Purchase FDEC (FT Vest U.S. Equity Buffer ETF – December) on the reset date, December 19, 2022, with a starting cap of 22.25% and a 10% buffer. One year later, the reference asset (SPY) finishes the outcome period up 22.45%. FDEC delivers its defined outcome, providing a total return of 21.69% (net of fees).

Option 2: Laddered Strategy (monthly, quarterly or semi-annual basis)

Potential benefits:

• Avoid the need to evaluate a monthly series of Buffer ETFs

• Maintain low volatility

• Diversified exposure

Example:

Allocate 25% to GJAN (FT Vest U.S. Equity Moderate Buffer ETF – January), 25% to GAPR (FT Vest U.S. Equity Moderate Buffer ETF – April), 25% to GJUL (FT Vest U.S. Equity Moderate Buffer ETF – July), and 25% to GOCT (FT Vest U.S. Equity Moderate Buffer ETF – October).

Option 3: Opportunistic Strategy

Purchase a Buffer ETF with your desired buffer level. If performance exceeds predetermined positive or negative thresholds, rotate – “step up” or “step down” – into the Buffer ETF that is closest to the start of its next outcome period, providing a fresh buffer and new upside cap.

Potential benefits:

• Evaluate for opportunistic portfolio resets during the outcome period

• Potential for outperformance compared to a static buffer strategy by attempting to capture gains in up markets and cutting losses in down markets

• Provide a fresh buffer and new upside cap

How to build your Buffer ETF portfolio

Step 1. Choose the reference asset for your Buffer ETF.

Buffer ETFs track various major stock market indices, so you need to choose your reference asset for the outcome period. Most Buffer ETFs track the SPDR S&P 500 ETF Trust (SPY), but if you want to track the Nasdaq-100 (QQQ), Russell 2000 (IWM), or foreign indices (EEM, EFA), they are also available for purchase.

Step 2. Choose your defined outcome period.

Most Buffer ETFs have a defined outcome period of 12 months, but there are also quarterly and semi-annual resets. Choose the outcome period that best fits your market outlook, time horizon, and risk profile.

Step 3. Choose your desired level of downside protection.

Buffer ETF issuers typically offer downside protection of 9%, 10%, 15%, 20%, or more. So, you need to decide how much protection you would like during the outcome period.

Step 4. Choose the Buffer ETF month to purchase.

Buffer ETFs are typically offered with annual reset dates. So, depending on when you are ready to purchase your Buffer ETF, invariably many will already be in the middle of an outcome period, which means the potential outcome parameters will be different than they were on the reset date. Typically, you will want to buy a Buffer ETF in the final hours of trading on the day before the new outcome period begins, so the timing of your allocation will likely depend on the date when you are ready to construct your portfolio. Thankfully, with so many Buffer ETFs to choose from, there is a Buffer ETF that resets every month, so you never need to wait long for a reset date to come around.

Step 5. Check the potential outcome parameters on the issuing company’s website before making a purchase.

Before making a Buffer ETF purchase, it’s critical you check the potential outcome parameters on the issuing company’s website. The parameters will change throughout the trading day, so it’s important to know the parameters (downside risk and upside potential) before entering an order.

Most issuers choose the last business day of the outcome period as the reset date. However, FT Vest resets its Target Outcome ETFs on the third Friday of the month, which corresponds with options expiration. You can view the reset dates for any Buffer series on the issuing company’s website. Visit www.allianzIM.com, www.ftportfolios.com, or www.innovatoretfs.com, for more information.

How to construct a simple Buffer ETF portfolio

Let’s assume you have $1 million to allocate in Buffer ETFs. You would like protection in your portfolio with upside growth potential, to a cap. Let’s build a simple Buffer ETF portfolio using two offerings from Innovator, the October and November U.S. Equity Power Buffer ETFs.

Innovator U.S. Equity Power Buffer – October (POCT)

A recommended purchase of POCT would take place in the final hours of trading on September 30, 2023, the day before the new outcome period begins. The upside cap for POCT had been indicated at over 15% the week prior to the reset date, with downside protection on the first 15% loss over the coming 12 months. Note, the issuing companies typically provide upside cap estimates beginning one week prior to the reset date. The stated gross cap for the new outcome period was 15.5%.

You could invest half your portfolio ($500,000) in POCT on September 30 to closely match the outcome parameters for the next 12 months.

Innovator U.S. Equity Power Buffer – November (PNOV)

So, you now have half your portfolio allocated in one Buffer ETF. You have decided to invest your remaining cash ($500,000) in the November Power Buffer series, which resets one month later, on October 31. PNOV provides protection on the first 15% loss of the reference asset, if purchased on the reset date. As the reset date nears, estimates for the cap level are favorable. The stated gross cap on the reset date was 15.7%.

A recommended purchase of PNOV would take place in the final hours of trading on October 31, 2023.

You could obviously stagger your Buffer ETF purchases over several months or more and build a laddered portfolio. However, if the upside cap is attractive when you have cash available to invest, there isn’t much reason to delay a purchase, unless you believe markets are very extended, overvalued and due for a sizeable correction. If not, one could argue to go ahead and allocate your entire portfolio within one to three months.

There are many ways to construct a Buffer ETF portfolio. A good way to start is to simply purchase one or two Buffer series, with the intention of holding them at least for the outcome period, and ideally as long-term investments.

Caveat Emptor (Buyer Beware): Do not purchase Buffer ETFs without knowing the potential outcome parameters. The parameters are updated daily by the issuers of Buffer ETFs. Buffer ETF potential outcome parameters change throughout each trading day, so you will always want to check them before making a purchase.

The three major issuers of Buffer ETFs, Innovator, FT Vest, and Allianz, all offer an ETF series each month that provides somewhat minimal downside protection, but typically with a very attractive upside cap. Innovator’s Buffer series provides 9% protection during the outcome period, and FT Vest and Allianz offer ETFs with 10% protection.

PGIM launched its first Buffer ETFs in January 2024, with one series offering minimal downside protection of 12%, and another series offering moderate downside protection of 20%.

Why consider a Buffer ETF that offers minimal downside protection?

• You want some protection in the market from a correction, but a relatively high upside cap.

• You are not concerned about a bear market, but you would still like some downside protection.

• You want to swap your unhedged stock portfolio for some downside protection.

When to consider a purchase of a Buffer ETF with minimal downside protection?

Likely an ideal time to purchase a Buffer series that offers minimal protection is if the reference asset you want to track has already experienced a fairly meaningful decline. Let’s say we are in the middle of a bear market and the underlying index you want to track (e.g., S&P 500) is already trading down 20% from its recent peak. At that point you might be much more interested in participating to the fullest extent possible in the upside, whenever the market recovers, but you may also still want some downside protection. You could purchase a Buffer series that offers some protection in case the market continues to drop, but also allows you to participate nicely in the upside if the market rebounds. Buffer ETFs with minimal protection typically offer the highest upside caps, so your profit potential should be quite attractive.

Consider a swap from a moderate or deep buffer to one offering minimal protection, but a higher upside cap.

If you own a Buffer ETF with moderate or deep downside protection and the reference asset has already had a significant decline, a swap to a 9% or 10% series with less protection, but a higher upside cap, should be considered. Due to the way options price within the ETF wrapper, Buffer ETFs that provide moderate or deep protection will typically have a beta (measure of volatility relative to the S&P 500) of approximately 0.5 or less. For example, if the reference asset is down 20% early in the outcome period, it’s likely your Buffer ETF with moderate or deep protection would show a loss of approximately half that amount, or 10%. So, you could consider rotating to a 9% or 10% Buffer ETF, which would allow for higher upside participation (a higher cap) whenever the reference asset recovers.

Note, the volatility of your Buffer ETF relative to its reference asset will change throughout the outcome period. Near the end of the outcome period, as the options within the ETF wrapper near expiration, your Buffer ETF will likely track the reference asset more closely and therefore have a higher beta.

Consider a swap of your unhedged stock portfolio to a Buffer ETF series with minimal downside protection.

If you have an unhedged stock portfolio and you are considering reducing your stock exposure, you could remain invested, but with some protection in Buffer ETFs. If you’d like to stay invested, but with slightly less risk, you could purchase a Buffer ETF that offers minimal downside protection, which should reduce the volatility in your portfolio and also give you some protection. This could be an attractive alternative to reducing your stock exposure, and it may provide you with some peace of mind that you didn’t have with your unhedged stock portfolio.

Minimal Downside Protection Buffer ETFs to consider:

Innovator U.S. Equity Buffer – Reference Asset: SPY

Buffer: 9%, Outcome Period: 12 Months, Expense Ratio: 0.79%

BJAN Buffer 9% – January

BFEB Buffer 9% – February

BMAR Buffer 9% – March

BAPR Buffer 9% – April

BMAY Buffer 9% – May

BJUN Buffer 9% – June

BJUL Buffer 9% – July

BAUG Buffer 9% – August

BSEP Buffer 9% – September

BOCT Buffer 9% – October

BNOV Buffer 9% – November

BDEC Buffer 9% – December

FT Vest U.S. Equity Buffer – Reference Asset: SPY

Buffer: 10%, Outcome Period: 12 Months, Expense Ratio: 0.85%

FJAN Buffer 10% – January

FFEB Buffer 10% – February

FMAR Buffer 10% – March

FAPR Buffer 10% – April

FMAY Buffer 10% – May

FJUN Buffer 10% – June

FJUL Buffer 10% – July

FAUG Buffer 10% – August

FSEP Buffer 10% – September

FOCT Buffer 10% – October

FNOV Buffer 10% – November

FDEC Buffer 10% – December

AllianzIM Buffer 10 Series – Reference Asset: SPY

Buffer: 10%, Outcome Period: 12 Months, Expense Ratio: 0.74%

JANT Buffer 10% – January

FEBT Buffer 10% – February

MART Buffer 10% – March

APRT Buffer 10% – April

MAYT Buffer 10% – May

JUNT Buffer 10% – June

JULT Buffer 10% – July

AUGT Buffer 10% – August

SEPT Buffer 10% – September

OCTT Buffer 10% – October

NOVT Buffer 10% – November

DECT Buffer 10% – December

PGIM U.S. Large-Cap Buffer 12 – Reference Asset: SPY

Buffer: 12%, Outcome Period: 12 Months, Expense Ratio: 0.50%

JANP Buffer 12% – January

FEBP Buffer 12% – February

MRCP Buffer 12% – March

APRP Buffer 12% – April*

MAYP Buffer 12% – May*

JUNP Buffer 12% – June*

JULP Buffer 12% – July*

AUGP Buffer 12% – August*

SEPP Buffer 12% – September*

OCTP Buffer 12% – October*

NOVP Buffer 12% – November*

DECP Buffer 12% – December*

*April – December series will be launched throughout 2024.

The two primary issuers of Buffer ETFs, Innovator and FT Vest, both offer an ETF series each month that provides protection against the first 15% loss during the outcome period. Pacer Swan SOS Moderate ETFs also offer protection against the first 15% loss. Allianz offers a series that provides protection against the first 20% loss, and PGIM recently launched a Buffer series that also provides protection against the first 20% loss.

Why consider a Buffer ETF that offers moderate downside protection?

• You want protection in the market from a fairly significant market decline, but with the potential to participate in the upside of the market, to a cap.

• You are not concerned about a bear market, but you would still like significant downside protection.

• You want to protect your unhedged stock portfolio with a moderate buffer.

A 15% or 20% buffer should provide a sufficient amount of downside protection in most market environments. You would typically only need more protection if you are concerned about a bear market. But again, in most market environments, moderate downside protection would be sufficient while typically also allowing for attractive upside potential over the outcome period.

When to consider a swap from a Buffer ETF with deep protection to a Buffer ETF with moderate protection?

If you own a Buffer ETF that provides 25% protection or more, you could consider swapping into a moderate Buffer series if the reference asset has already had a significant decline during the outcome period. By swapping into a Buffer series with less protection (after a market decline), the upside cap will be higher, so whenever the market recovers you could potentially participate more fully in the upside.

Consider swapping your unhedged stock portfolio for a Buffer ETF series that offers moderate downside protection.

If you have an unhedged stock portfolio and you are concerned about potential losses, but you don’t want to miss out on gains if the market moves higher, you could swap into a moderate Buffer ETF to retain exposure to the market, but with less risk. You reduce your risk, but you also have the potential to participate in the upside of the market, to a cap. A hedged stock portfolio with Buffer ETFs can allow you to stay invested, but with some downside protection.

Moderate Downside Protection Buffer ETFs to consider:

Innovator U.S. Equity Power Buffer – Reference Asset: SPY

Buffer: 15%, Outcome Period: 12 Months, Expense Ratio: 0.79%

PJAN Power Buffer 15% – January

PFEB Power Buffer 15% – February

PMAR Power Buffer 15% – March

PAPR Power Buffer 15% – April

PMAY Power Buffer 15% – May

PJUN Power Buffer 15% – June

PJUL Power Buffer 15% – July

PAUG Power Buffer 15% – August

PSEP Power Buffer 15% – September

POCT Power Buffer 15% – October

PNOV Power Buffer 15% – November

PDEC Power Buffer 15% – December

FT Vest U.S. Equity Moderate Buffer – Reference Asset: SPY

Buffer: 15%, Outcome Period: 12 Months, Expense Ratio: 0.85%

GJAN Moderate Buffer 15% – January

GFEB Moderate Buffer 15% – February

GMAR Moderate Buffer 15% – March

GAPR Moderate Buffer 15% – April

GMAY Moderate Buffer 15% – May

GJUN Moderate Buffer 15% – June

GJUL Moderate Buffer 15% – July

GAUG Moderate Buffer 15% – August

GSEP Moderate Buffer 15% – September

GOCT Moderate Buffer 15% – October

GNOV Moderate Buffer 15% – November

GDEC Moderate Buffer 15% – December

Pacer Swan SOS Buffer Moderate Series – Reference Asset: SPY

Buffer: 15%, Outcome Period: 12 Months, Expense Ratio: 0.60%

PSMO Buffer 15% – October

PSMJ Buffer 15% – July

PSMD Buffer 15% – January

PSMR Buffer 15% – April

AllianzIM Buffer 20 Series – Reference Asset: SPY

Buffer: 20%, Outcome Period: 12 Months, Expense Ratio: 0.74%

JANW Buffer 20% – January

FEBW Buffer 20% – February

MARW Buffer 20% – March

APRW Buffer 20% – April

MAYW Buffer 20% – May

JUNW Buffer 20% – June

JULW Buffer 20% – July

AUGW Buffer 20% – August

SEPW Buffer 20% – September

OCTW Buffer 20% – October

NVBW Buffer 20% – November

DECW Buffer 20% – December

PGIM U.S. Large-Cap Buffer 20 – Reference Asset: SPY

Buffer: 20%, Outcome Period: 12 Months, Expense Ratio: 0.50%

PBJA Buffer 20% – January

PBFB Buffer 20% – February

PBMR Buffer 20% – March

PBAP Buffer 20% – April*

PBMY Buffer 20% – May*

PBJN Buffer 20% – June*

PBJL Buffer 20% – July*

PBAU Buffer 20% – August*

PBSE Buffer 20% – September*

PBOC Buffer 20% – October*

PBNV Buffer 20% – November*

PBDE Buffer 20% – December*

*April – December series will be launched throughout 2024.

The two primary issuers of Buffer ETFs, Innovator and FT Vest, offer an ETF series each month with deep downside protection. Innovator’s offerings provide protection against a 30% loss during the outcome period, and FT Vest offers a series that provides protection against a 25% loss. Pacer Swan SOS Conservative ETFs also offer protection against a 25% loss.

A key consideration for Deep Buffer ETFs is that they do not provide protection against the first 5% loss of the reference asset. In order to have an attractive upside cap during the outcome period, Buffer ETFs that offer a deep buffer must be structured to forgo protection on the first 5% loss. The first 5% level of protection is costly, so by not providing protection on the first 5% loss, it allows for a higher upside cap.

For investors who are willing to forgo protection on the first 5% loss of the reference asset, Buffer ETFs with deep downside protection can be attractive.

Why consider a Buffer ETF that offers deep downside protection?

• You want protection from a significant market decline, but you would still like the potential to participate in the upside of the market, to a cap.

• You are a conservative investor who would like more upside return potential than bonds are offering.

• You have an unhedged stock portfolio and you would like to protect against potentially deep market losses.

• You are risk averse and concerned about potential losses, but you recognize the need for some growth potential in your portfolio.

25% or 30% downside protection should shield your portfolio from deep losses in the average historical bear market decline of 34%. But again, the key consideration here is that you are not protected against the first 5% loss during the outcome period.

Deep Downside Protection Buffer ETFs to consider:

FT Vest U.S. Equity Deep Buffer – Reference Asset: SPY

Buffer: 25% (-5% to -30%), Outcome Period: 12 Months, Expense Ratio: 0.85%

DJAN Deep Buffer 25% – January

DFEB Deep Buffer 25% – February

DMAR Deep Buffer 25% – March

DAPR Deep Buffer 25% – April

DMAY Deep Buffer 25% – May

DJUN Deep Buffer 25% – June

DJUL Deep Buffer 25% – July

DAUG Deep Buffer 25% – August

DSEP Deep Buffer 25% – September

DOCT Deep Buffer 25% – October

DNOV Deep Buffer 25% – November

DDEC Deep Buffer 25% – December

Pacer Swan SOS Buffer Conservative Series – Reference Asset: SPY

Buffer: 25% (-5% to -30%), Outcome Period: 12 Months, Expense Ratio: 0.60%

PSCQ Buffer 25% – October

PSCJ Buffer 25% – July

PSCX Buffer 25% – January

PSCW Buffer 25% – April

Innovator U.S. Equity Ultra Buffer – Reference Asset: SPY

Buffer: 30% (-5% to -35%), Outcome Period: 12 Months, Expense Ratio: 0.79%

UJAN Ultra Buffer 30% – January

UFEB Ultra Buffer 30% – February

UMAR Ultra Buffer 30% – March

UAPR Ultra Buffer 30% – April

UMAY Ultra Buffer 30% – May

UJUN Ultra Buffer 30% – June

UJUL Ultra Buffer 30% – July

UAUG Ultra Buffer 30% – August

USEP Ultra Buffer 30% – September

UOCT Ultra Buffer 30% – October

UNOV Ultra Buffer 30% – November

UDEC Ultra Buffer 30% – December

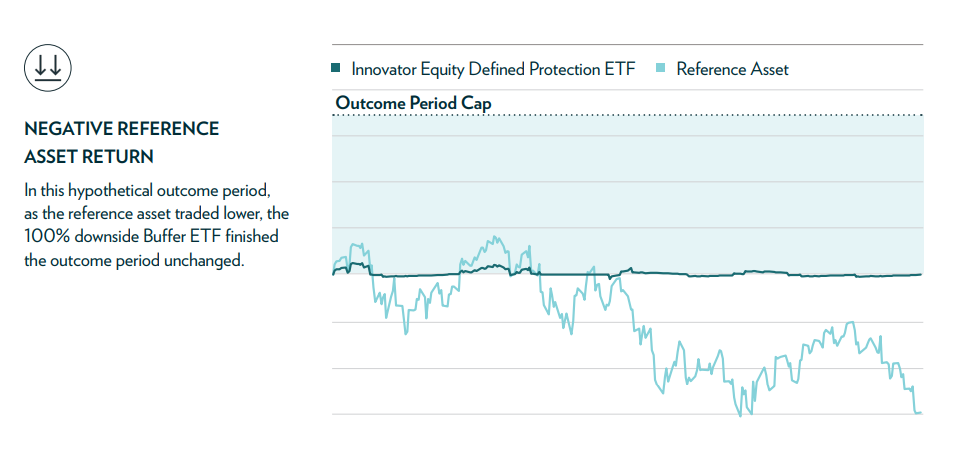

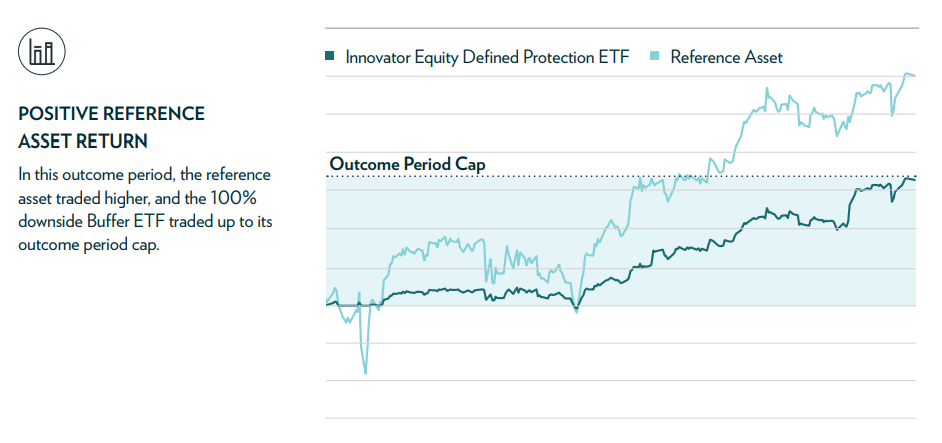

Innovator Capital Management launched a new Buffer ETF in July 2023 that seeks to provide equity upside participation with 100% downside protection. The Innovator Equity Defined Protection ETF (TJUL) is the first ETF to promise full downside protection over the outcome period. Note, a January 2024 series (AJAN) has also recently started trading, and others are planned to launch throughout 2024.

TJUL will track the return of the SPDR S&P 500 ETF Trust (SPY), up to a cap of 16.6% (before fees) while buffering investors against 100% of losses over the outcome period of two years. Investors forgo dividend income and pay an annual expense ratio of 0.79%. The outcome period for investors seeking full downside protection is double the standard outcome period of 12 months for most Buffer ETFs. So, investors need to be prepared to stay invested for the entire two-year period to realize the defined outcome.

Like other Buffer ETFs, this product also invests in a basket of FLEX options with varying strike prices. The strategy involves buying call options to gain SPY exposure and put options for downside protection, and then offsetting the costs by selling call options, which caps upside returns.

Many investors purchase annuities, structured notes, or market-linked CDs that protect against losses, but come with higher fees, carry high investment minimums, long lock-up periods, and unfavorable tax treatment. ETFs like TJUL can be a better option for ultra-conservative investors.

To consider:

1. You need to hold TJUL for the full two-year outcome period to get the total downside protection.

While TJUL can be bought or sold at any time, just like any stock or ETF, you need to hold TJUL for the entire outcome period established by the fund in order to achieve the expected returns. This is in line with the structure of the FLEX options used in order to try to achieve the desired outcome, which in TJUL’s case is 100% downside protection.

In the case of TJUL, the outcome period is from July 18, 2023 to June 30, 2025. At the end of the two-year period, TJUL will automatically reset in a tax-efficient manner, and establish a new two-year outcome period (new upside cap with full downside protection). So, TJUL can be held as a long-term investment.

2. There’s a cap on upside performance.

In order to have 100% downside protection, you have to give up some upside potential. In TJUL’s case, the cap on the return is 16.62% (before fees) over the two-year outcome period. In other words, you capture 100% of the positive performance of the reference asset (SPY) up to 16.62%, but you’ll forgo any extra gains achieved by SPY during the outcome period.

3. Returns will vary during the outcome period.

It’s important to note that your returns during the two-year outcome period will vary if you buy TJUL before or after the reset date. FLEX options are designed to produce the desired outcome on the last day of the outcome period.

During the outcome period, TJUL will not move in a 1:1 relationship with SPY. Buffer ETFs usually come with much less volatility than their benchmark index and move gradually.

Again, returns will vary if you buy or sell within the outcome period. If you buy when TJUL is already up 5%, for example, you’ll have less upside potential remaining to the cap. And, in this example, there’s also the possibility that you lose money investing in TJUL because the 5% unrealized gain could be lost if the reference asset declines and shows a loss at the end of the outcome period.

Who should consider buying 100% downside protection Buffer ETFs?

• You are extremely conservative and want total protection of your principal.

• You are wary of high stock market valuations and you believe the downside risk in the market is far greater than a typical bear market.

• You fear we may be heading for a market crash, but you’d like to hedge and remain invested with some upside potential, if your fears prove unwarranted.

Summary: The idea of 100% downside protection built around an investment in the S&P 500 should be attractive to ultra-conservative investors, even if it comes at the expense of capped upside.

Note, in March 2024, FT Vest launched a 100% downside protection Buffer ETF, FT Vest U.S. Equity Max Buffer (MARM), with a one-year outcome period. The gross cap on the launch date was 9.23% and the expense ratio is 0.85%.

As we learned in the section titled Deep Downside Protection, the cost of the first 5% downside protection with Buffer ETFs is expensive. In order for issuers to offer deep buffers with an attractive upside cap, investors have had to forgo protection on the first 5% loss of the reference asset during the outcome period. Unfortunately, this isn’t all that appealing to investors who prefer total downside protection to a certain buffer level. Can you construct a deep buffer portfolio without giving up protection on the first 5% loss? Absolutely.

Here’s a creative way to allocate a portfolio to protect against the first 5% loss, all the way down to -30% or -35%. Being able to protect to a decline of 35% will shield your portfolio in pretty much any market meltdown scenario other than a severe market crash, where losses could hit 50% or more, peak-to-valley.

Let’s assume you have a $1 million portfolio. By dividing your portfolio evenly between 3-month Treasury bills and a Deep or Ultra Buffer ETF, you can effectively cover the first 5% loss on the entire portfolio, down to -30% or -35%, while also having attractive upside potential with half your portfolio.

Let’s look at how your portfolio could be constructed with some hypothetical return scenarios.

Portfolio Allocation: 50% Treasury Bills & 50% Deep Buffer ETF

50%: 3-month Treasury bills (5.4% annualized yield)

50%: FT Vest U.S. Equity Deep Buffer ETF (DJAN – January 2024)

On its recent reset date, DJAN offered downside protection of 25% (-5% to -30%) over a 12-month outcome period while offering a gross cap of approximately 14%. This is a pretty nice potential 12-month return, but you might not want to give up protection on the first 5% loss of the reference asset.

With $500,000 allocated in Treasury bills, and assuming you roll the position every three months and the yield stays above 5% for the full outcome period, you could effectively cover the potential 5% loss on DJAN. If the reference asset (SPY) shows a 5% loss at the end of the outcome period, but not more than -30%, the total return for the portfolio would be flat, before fees. This is not a bad outcome if the reference asset has tumbled.

Down-Market Scenario

Let’s assume the reference asset (SPY) declines 20% during the outcome period. This would obviously not affect the return of the Treasury bills, so over the outcome period, the Treasury bills would earn $27,000. Again, this assumes 3-month Treasury bills earn 5.4% annualized (rolled every quarter to new T-bills) during the outcome period, and earn the same percentage return for the full 12 months.

DJAN, which provides deep protection to -30%, but does not provide protection on the first 5% loss, would have lost 5% if the reference asset (SPY) declined 20%. So, DJAN would show a loss of $25,000 at the end of the outcome period.

The total return for the portfolio (before fees) would be flat – a slight gain of $2,000 (the dollar difference between the loss on DJAN and the gain on the Treasury bills).

Here’s the total return breakdown of the portfolio in this hypothetical down-market scenario (before fees):

Treasury bills return: 5.4% on $500,000 = $27,000

DJAN return: -5.0% on $500,000 = -$25,000

Total return: $2,000 or 0.20%

Up-Market Scenario

Now, let’s assume the reference asset (SPY) has a strong 12-month period following your purchase of Treasury bills, and DJAN on its reset date. DJAN had a gross upside cap of approximately 14% during the outcome period.

Over the outcome period, the Treasury bills would not be affected whatsoever by the returns (up or down) of the reference asset (SPY), so the return on the Treasury bills would be the same as in the down-market scenario: $27,000, assuming a 5.4% annualized return.

Let’s assume the reference asset gained 18% during the outcome period. DJAN was capped at a gross percentage gain of approximately 14%, so the investor basically forfeited the gain beyond 14% during the outcome period.

Here’s the total return breakdown of the portfolio in this hypothetical up-market scenario (before fees):

Treasury bills return: 5.4% on $500,000 = $27,000

DJAN return: 14% on $500,000 = $70,000

Total return: $97,000 or 9.7%.

This hypothetical up-market scenario allowed the investor to nearly double the return that would have been earned by a portfolio 100% allocated in Treasury bills. And, with deep downside protection, a conservative investor should have had a high level of confidence and peace of mind knowing there was protection on the total portfolio, even if the reference asset (SPY) dropped 30% at the end of the outcome period.

This is just one example of how to incorporate Buffer ETFs in a portfolio to achieve a potential defined outcome. There are many ways to creatively allocate a portfolio to obtain a desired level of downside protection.