What are the advantages of owning Buffer ETFs?

• Buffer ETFs allow you to participate in the upside of the stock market, to a cap, but with downside protection.

• Buffer ETFs allow you to track well-known stock market indices (e.g., S&P 500, Nasdaq 100) with downside protection and an upside cap.

• Buffer ETFs allow you to choose your level of downside protection based on your risk profile. There are Buffer ETFs that are appropriate for conservative, moderate, or aggressive investors.

• Buffer ETFs allow you to track your chosen stock market index (reference asset) with less volatility than the market itself.

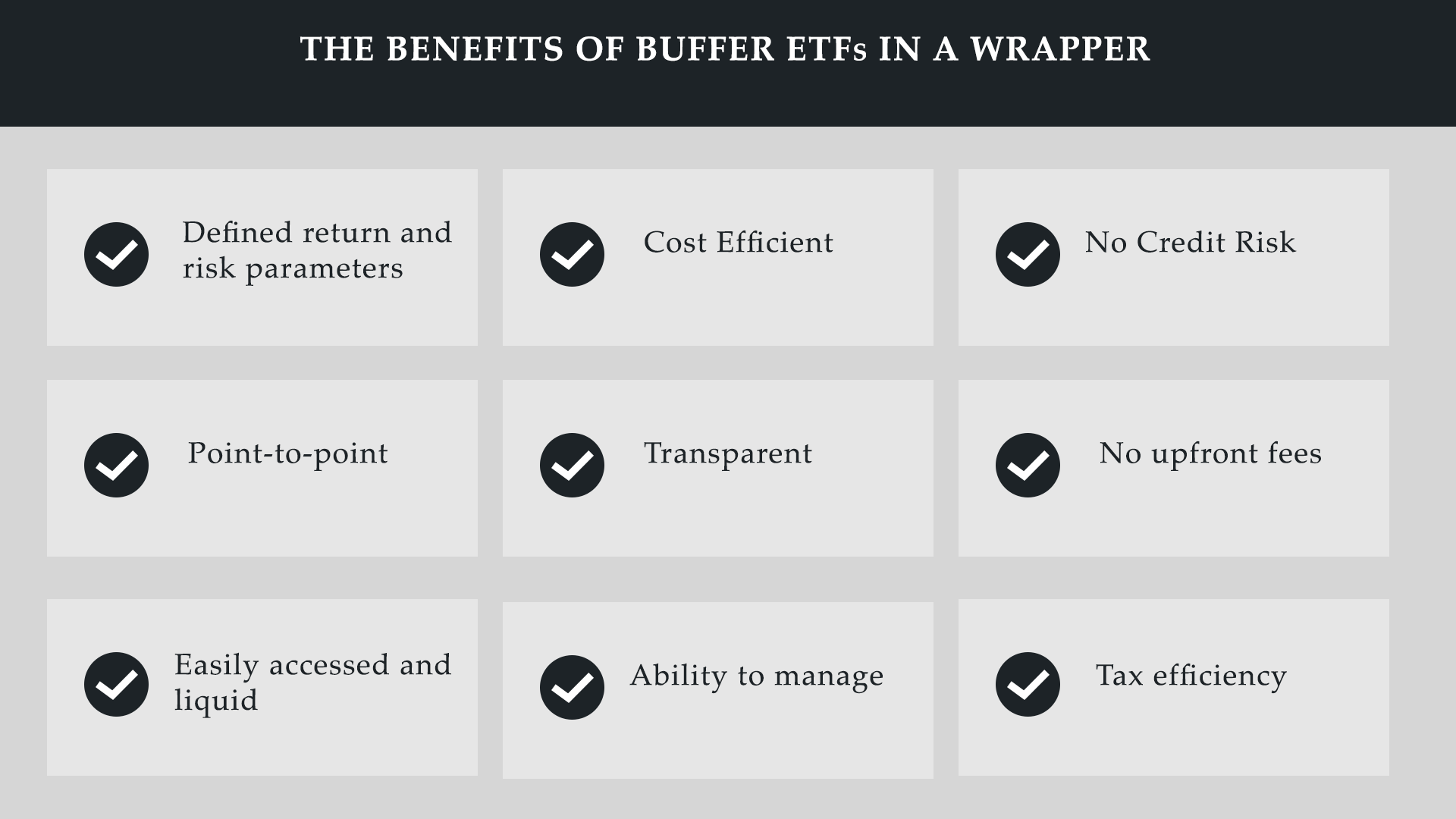

• Buffer ETFs trade like stocks and other ETFs with daily liquidity and transparency.

• Buffer ETFs have no credit risk.

• Unlike many structured products, like annuities, Buffer ETFs have no lock-up periods or surrender charges.

• Buffer ETFs automatically reset at the end of the outcome period with a fresh “buffer” for protection and a new upside cap.

• Buffer ETFs are tax efficient. Thanks to the ETF wrapper, the resets are done in a tax-efficient manner.

• Buffer ETFs are suitable for both tax-deferred and taxable accounts.

• Buffer ETFs appeal to conservative and moderate-risk investors who are looking for stable growth with less volatility and decreased risk of loss.

• Buffer ETFs allow risk-averse investors the opportunity to participate in the stock market, but with much-needed downside protection.

• Buffer ETFs allow investors nearing retirement or already retired, the ability to still participate in the growth of the stock market, to a cap, but with protection.

• Buffer ETFs allow investors who are concerned about a correction or bear market, a way to stay invested in the stock market, but with downside protection.

• The downside protection provided by Buffer ETFs allows investors to stay invested in the stock market even during times of high valuations and heightened risk.

• Buffer ETFs are a conservative way to allocate cash into the market without full downside exposure to losses. They allow for less volatile and more comfortable reinvesting into the stock market.

• Buffer ETFs offer a viable alternative to a traditional 60/40 stock-bond portfolio allocation, with the possibility of higher growth.

• Buffer ETFs are an attractive, risk-managed, core portfolio holding, for long-term investors.

What are the disadvantages of owning Buffer ETFs?

There are not many disadvantages of owning Buffer ETFs, but they aren’t a perfect solution in every stock market environment. The risks are at the extremes. If you buy a Buffer ETF that offers 15% downside protection, but the reference asset tumbles 25% over the outcome period, you’ll lose the difference, or 10% (plus fees). And, if the reference asset soars coming out of a correction or bear market, but your upside is capped, you’ll forgo some potentially high returns.

Probably the most obvious time to have reduced exposure to Buffer ETFs, is if the stock market is already deep in bear market territory, or in the aftermath of a crash. If stock valuations are attractive, and the reference asset is already trading down 20% or more from its peak, you will likely not want to own Buffer ETFs, or only own those that offer minimal downside protection. The reason is you don’t want to cap your upside after a steep downturn. Often stocks can skyrocket coming out of a deep bear market or crash, so you will likely not want to have your potential returns capped at any level.

Note, with the recent launch of Allianz’s Uncapped Buffer ETFs, there are now attractive Buffer ETFs to consider when stock prices are already depressed and trading at attractive valuations during deep corrections or bear markets. More on this in a later section.

Is capping your upside return potential in exchange for downside protection the right decision for you?

You may question whether or not it makes sense to limit your upside return potential in order to have downside protection in your portfolio. The primary reason to accept a cap in exchange for downside protection is that you can greatly reduce the likelihood of large negative returns and this is arguably much more important than potentially missing out on high positive returns. There is a strong case to be made for accepting this trade-off with Buffer ETFs, especially for investors who are relying on their assets in retirement and cannot afford the negative effects of deep market drawdowns.

If you are nearing retirement or already retired, you should seriously consider whether or not you can handle, from a financial perspective, deep losses in your portfolio that invariably will happen without some level of downside protection. If history is a guide, if you have an unhedged stock portfolio, your portfolio could lose at least 30% in a bear market. Calculate what that loss would look like in dollar terms for your portfolio. Can you truly afford the loss or will it adversely affect your lifestyle?

Bottom line, if you cannot afford to lose 30% or more in your stock portfolio during the next bear market, then please consider the advantages of investing in Buffer ETFs.