BUFFER ETFS SEEK TO TAKE ADVANTAGE OF MARKET growth to a cap, with a defined level of downside protection (a buffer) against losses. The price you pay for your Buffer ETF shares determines your defined outcome for the remainder of the outcome period.

Your defined outcome is not impacted by other investors. The cap and buffer level are set at the beginning of each outcome period.

Market Exposure

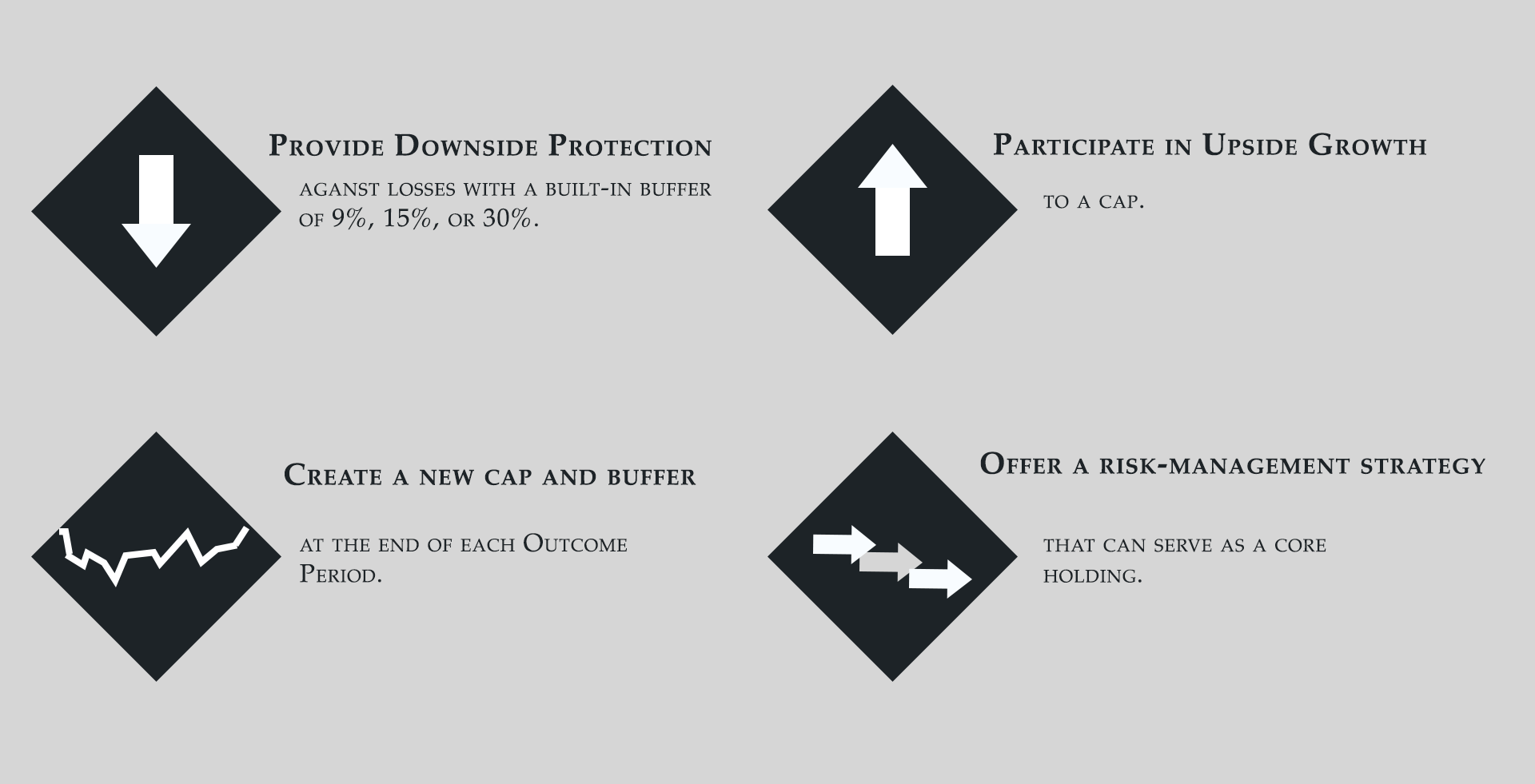

Buffer ETFs provide exposure to the price return of a major stock market index, to a cap.

Built-in Downside Buffer

Choose your defined buffer level, typically 9%, 10%, 12%, 15%, 20% or more, to help limit losses.

ETF wrapper

Buffer ETFs are available in a benefit-rich exchange-traded fund wrapper.

Outcome period

Buffer ETFs typically seek to deliver results over a one-year time horizon, at which point the ETFs automatically rebalance, in a tax-efficient manner, providing a fresh downside buffer and a new upside cap