The ability to buy and sell Buffer ETFs throughout the outcome period introduces some attractive applications. This includes the ability to capture gains at any point during the outcome period. One can analyze the benefits and risks from rotating from one Buffer ETF to another.

Stepping up to a new Buffer Series allows an investor to:

- Expand the upside cap

- Obtain a fresh downside buffer

- Eliminate “downside before buffer” risk

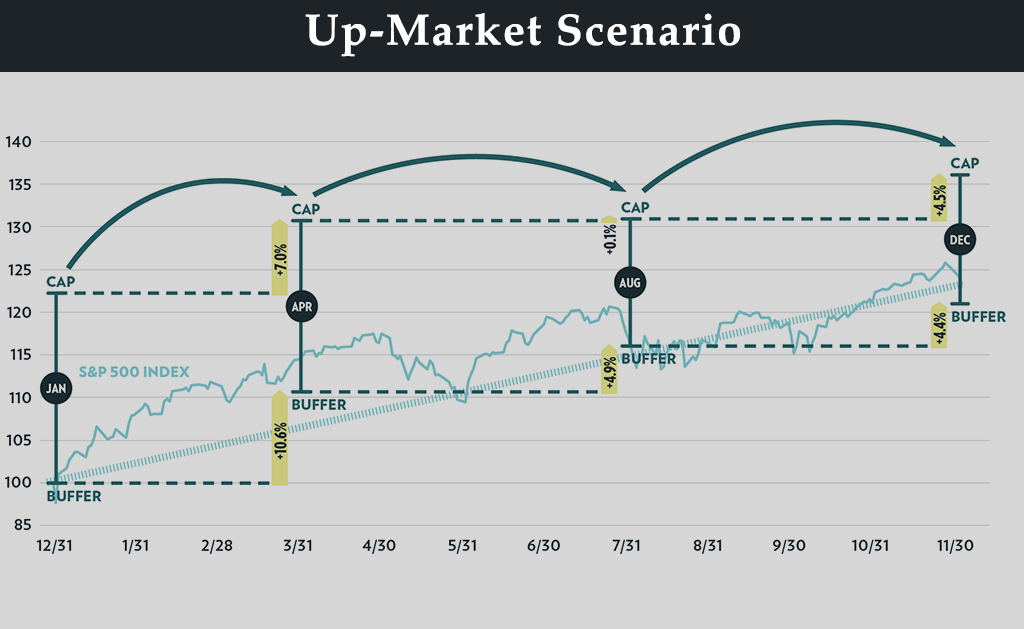

Up-Market Scenario

The graph illustrates the starting buffer and cap levels of various Innovator Buffer ETFs. In rising markets, “stepping up” into a new Buffer series may be a beneficial approach to locking in gains, expanding upside potential and resetting the buffer level at the same time. This is possible because of the monthly issuance of Buffer ETFs.

The resetting of a buffer means a new full downside buffer can be achieved and this allows an investor to hedge against the next 9% or 15% loss, for example.

The hypothetical graph highlights how an investor could use the January series to achieve an approximate 10% return, then roll into the April series. Doing so would expand the cap (7% from the original cap) as well as reset the buffer at a new, higher level. Moving from the April to the August series expands the cap by only 0.1%, but since the April series has appreciated approximately 5%, this sets the new buffer at a 5% higher level. This type of rotation, through the liquidity of Buffer ETFs, allows an investor to expand upside caps while resetting downside buffers at higher levels.

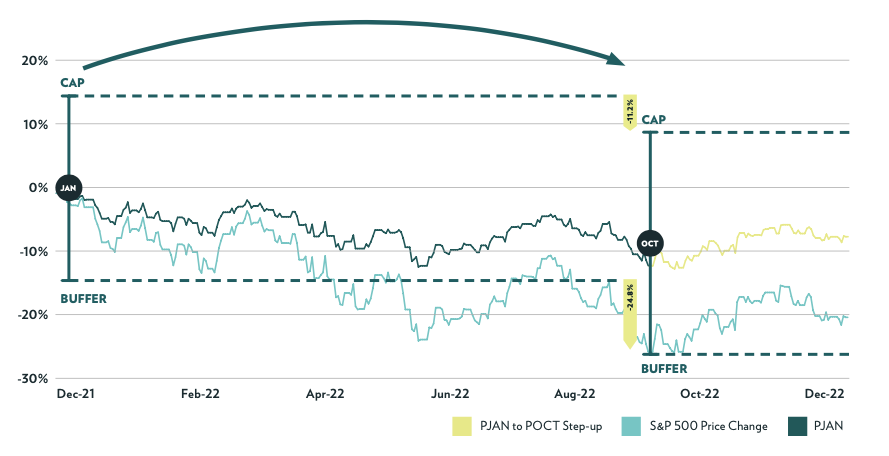

Down-Market Scenario

Conversely, investors may identify opportunities to “step down” after the reference asset has declined, and a Buffer ETF is in its “buffer zone.” For example, if the reference asset, SPY, has retreated and the Buffer ETF has outperformed (lost less than the reference asset), this provides an opportunity for an investor to rotate into a Buffer ETF with less protection (e.g., rotate from a 15% buffer to a 9% buffer). This move would reset an investor’s buffer level, provide an additional 9% downside protection, while also increasing the upside potential (higher cap) should the market begin to rally.

Another example of a potentially attractive step-down strategy can be seen in the hypothetical graph. Let’s assume an investor purchased PJAN (Innovator U.S. Equity Power Buffer – January) on its reset date at the start of 2022. It provided downside protection against the first 15% loss of the reference asset, with an upside cap of 9%. By October, SPY had declined a whopping 24.8%, but PJAN had declined only 11.2%. This outperformance gave the investor the opportunity to: 1) rotate into a Buffer ETF with less protection (9% series) and a higher upside cap with better appreciation potential, or 2) rotate into another Buffer ETF with the same level of downside protection (15%), but with better upside potential (higher cap) over the next 12 months.

The graph shows a hypothetical rotation out of PJAN and into POCT, which created additional downside protection of 15% from the current price level of the reference asset. It also provided an attractive new upside cap. The volatility in the market had pushed caps higher during 2022, and POCT offered a very high gross cap of 20.7% on its reset date.

Both strategies could have been considered for a PJAN shareholder: 1) rotate into a 9% Buffer ETF, or 2) rotate into a 15% Buffer ETF. The choice likely would have depended on how much more downside risk the investor thought there could be in the reference asset below its current decline of 24%. The risk-averse investor would have likely opted for another 15% protective buffer, despite the market’s already steep decline. Regardless, both strategies provided additional downside protection with fresh buffers, as well as high upside caps, to hopefully recoup losses and profit in a rebounding market.