Buffer Income ETFs are designed for investors looking for monthly income with a defined level of protection against losses. Most Buffer ETFs do not pay income to investors, so Buffer Income ETFs provide a solution by providing stable income. The high income, along with a defined level of downside protection, should appeal to income-oriented investors.

Why Buffer Income ETFs?

- Generate income with monthly distributions

- Defined rate of income over the outcome period

- Maintain built-in buffers to protect against losses

- Cost effective, flexible, liquid and transparent

- No bank credit risk

- Rebalance annually and can be held indefinitely

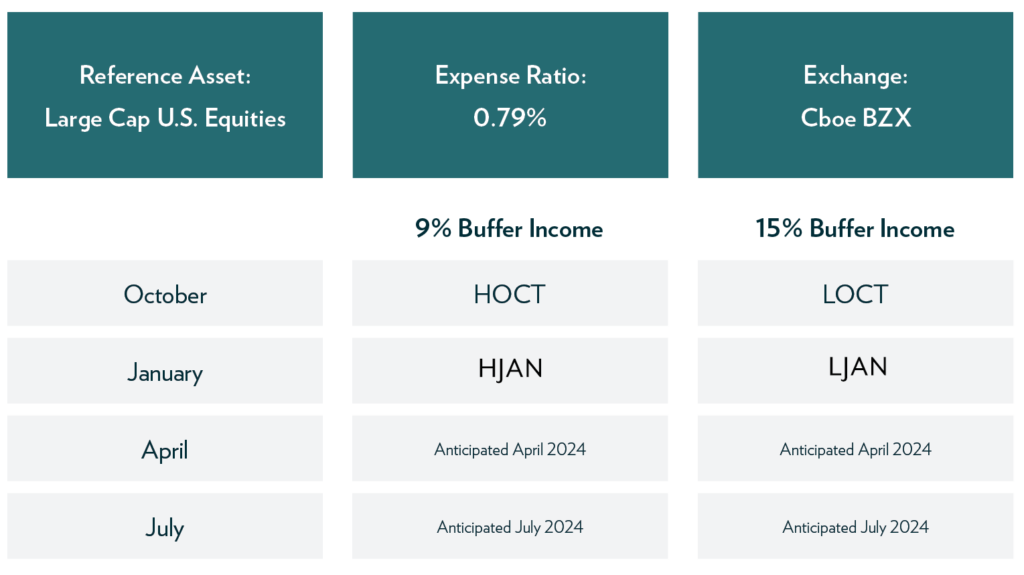

Innovator is currently in the middle of its launch of Buffer Income ETFs and there are two series available (October and January) that provide a 9% buffer and a 15% buffer. More Buffer Income ETFs will be launched throughout 2024.

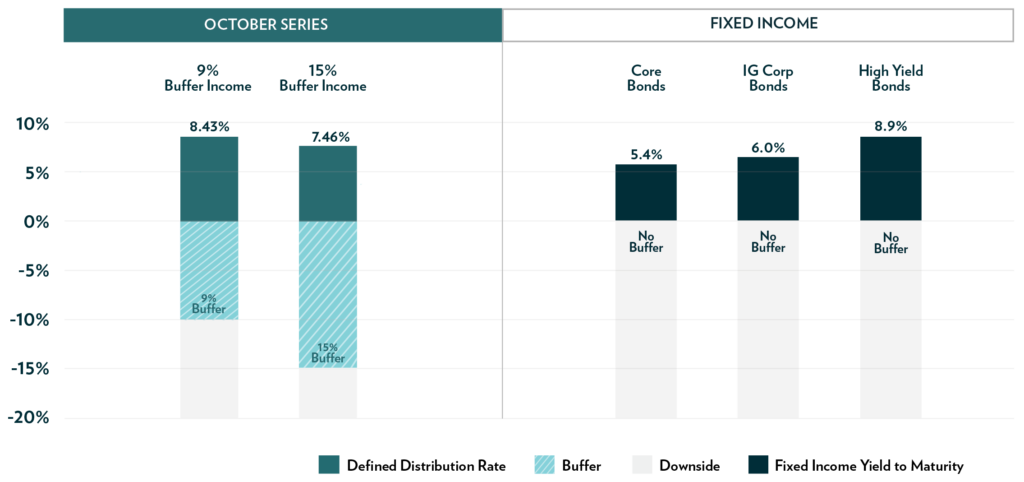

Where do they fit in a portfolio?

Buffer Income ETFs are designed to help diversify a fixed-income portfolio. Traditional fixed-income investments do not offer downside protection (no buffer), so Buffer Income ETFs can provide some much-needed protection.

Buffer Income ETFs are designed to:

How do Buffer Income ETFs work?

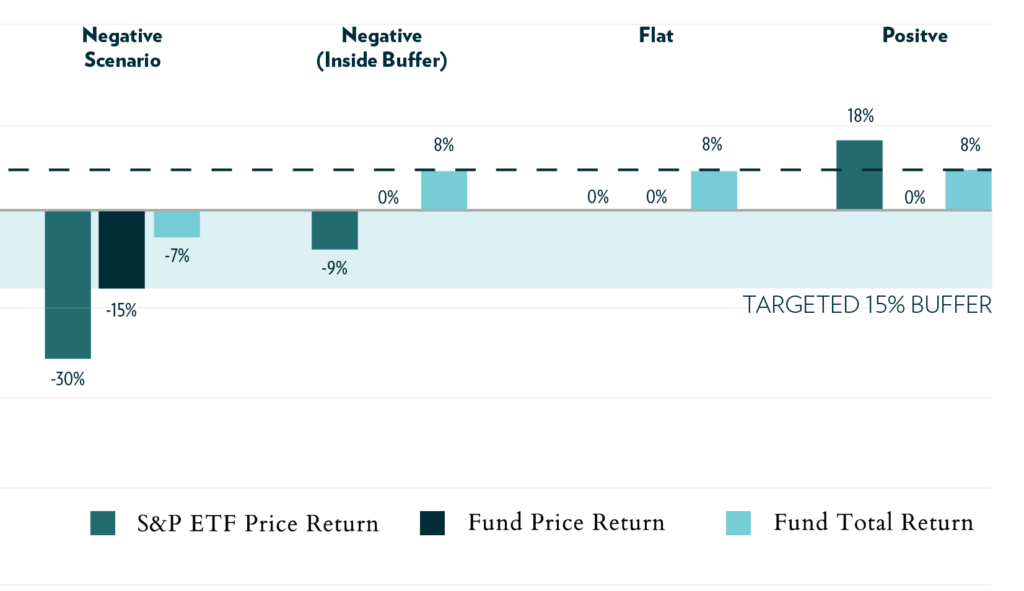

Buffer Income ETFs use a combination of options and U.S. Treasuries to create their exposure. The result of the portfolio construction is a strategy that is engineered to generate meaningful income return potential in both positive and negative markets.

The hypothetical chart below uses a 15% buffer strategy as an example and assumes an 8% distribution rate during the outcome period.

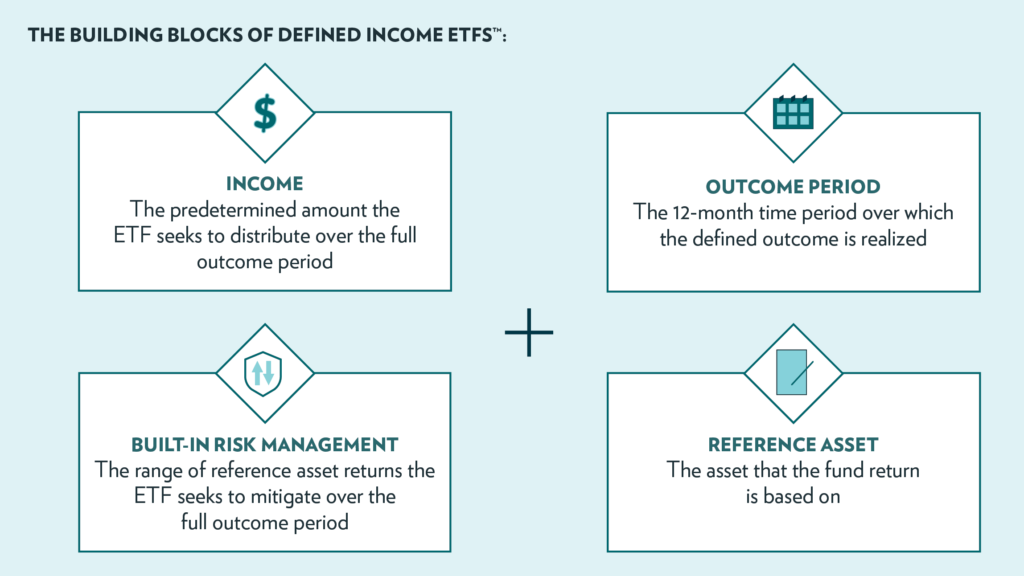

What are the building blocks of Defined Income ETFs?

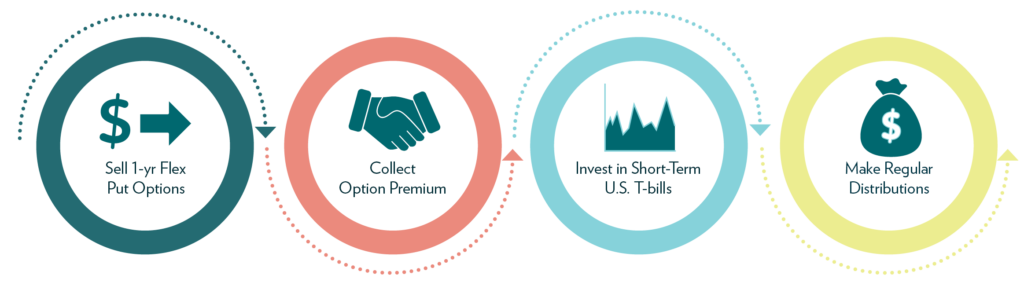

How do Buffer Income ETFs generate income?

Buffer Income ETFs generate high relative rates of income through a combination of option premiums and U.S. Treasury bills.

- Sell a one-year FLEX put option

- Collect the option premium

- Invest in short-term U.S. Treasury bills

- Make monthly distributions to investors

The final distribution of each outcome period is made the same day that the ETF resets its distribution rate and buffer.

What are the break-even return levels for Buffer Income ETFs?

The break-even return level is the point at which, over a full 12-month outcome period, a Buffer Income ETF will start to show losses on a total return basis. In the chart below we’ll see two hypothetical break-even scenarios for a 9% and 15% Buffer Income ETF:

Let’s assume a 15% Buffer Income ETF has a distribution rate of 7.5%. The reference asset (S&P 500) would have to fall more than 22.5% over the outcome period for the ETF to incur a loss on a total return basis.

15% Buffer Income ETF: Reference asset declines 22.5% with a distribution rate of 7.5%. 22.5% – 7.5% = 15%, which is the level of buffer protection provided at the outset during the outcome period.

The 9% Buffer Income ETF, with a distribution rate of 8.4%, would start to show a loss, on a total return basis, if the reference asset (SPY) falls more than 17.4% during the outcome period.

9% Buffer Income ETF: Reference asset declines 17.4% with a distribution rate of 8.4%. 17.4% – 8.4% = 9%, which is the level of protection provided at the outset during the outcome period.

If the reference asset declined more than the difference between the buffer level and the percentage of income received, then the investor would show a loss on a total return basis.

Let’s look at another example and assume an investor owns a Buffer Income ETF with 15% downside protection and it distributes 6% annual income during the outcome period. The reference asset could fall 21% before the investor loses money on a total return basis. If the reference asset lost 30% and the investor only earned a 6% distribution rate, but had a 15% buffer, he would lose 9% on a total return basis. He lost 15% on the reference asset (30% – 15% = 15% below the buffer), but received 6% income which helped recoup some of the loss. Total return = -9%.

Another example, using a 9% Buffer Income ETF, assumes a 5.5% distribution rate. The break-even level is 14.5%. Any loss of the reference asset below 14.5% will be a real loss – unprotected for the investor. If the reference asset declined 21% during the outcome period the total return for the investor would be 6.5%. (21% loss – 9% buffer = 12% loss on the reference asset. Add in the distribution income of 5.5% and your total return would have been a loss of 6.5%.

Buffer Income ETFs have many advantages over traditional income strategies and generally offer very competitive distribution rates with a moderate level of downside protection. They should be considered by any investor in need of a consistent income stream.