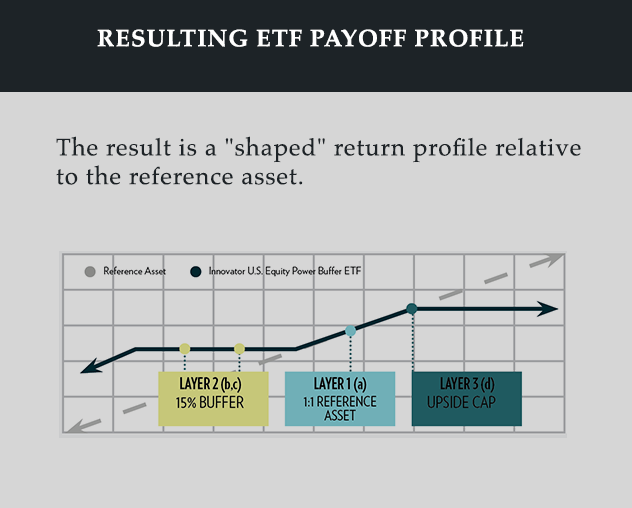

Each Buffer ETF is typically made up of a package of options. While the package’s options are all established at the same time, it can be helpful to visualize them as different layers.

Using a Buffer ETF with 15% downside protection as an example, the charts in this section illustrate how each layer contributes to the construction of the defined outcome.

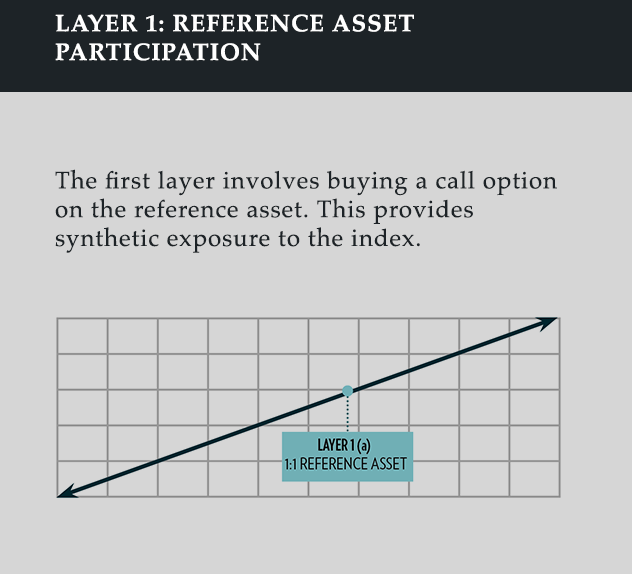

Layer 1

Reference asset exposure

The first layer involves buying a call option on the reference asset.

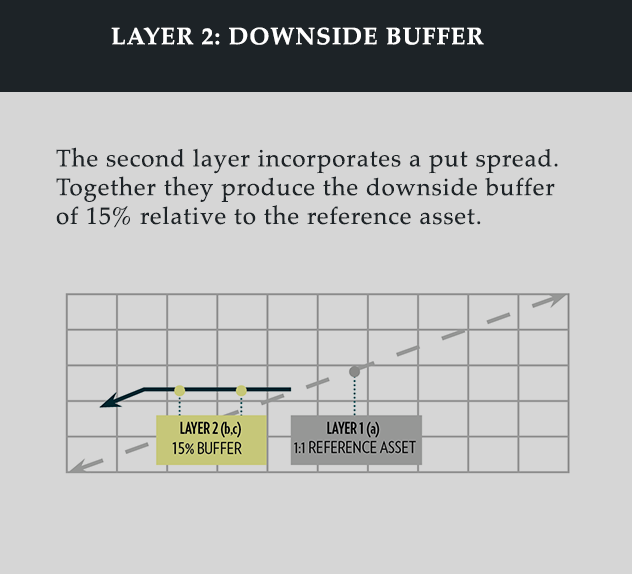

Layer 2

Downside Buffer

The second layer incorporates a put spread. Together, the long and short put produce the downside buffer of 15%.

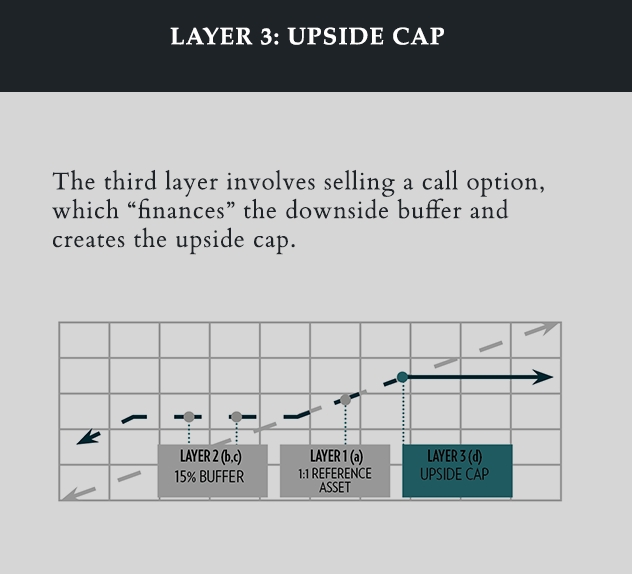

Layer 3

Upside cap

The third layer involves selling a call option. The call is sold as far out of the money as possible, while still generating enough premium to help cover the cost of the protective put in Layer 2. The sale of this call creates the upside cap.