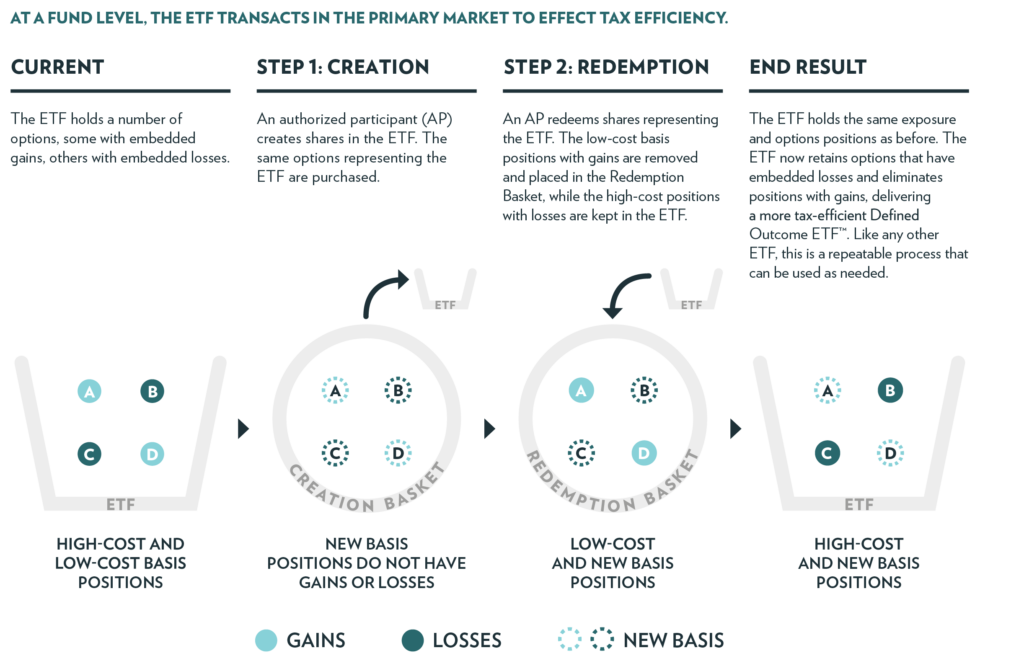

The same benefits of the ETF creation/redemption process that make stock and bond ETFs more tax efficient can also be utilized with Buffer ETFs. Through the creation/redemption process, the ability to redeem gains and keep losses in the portfolio should allow Buffer ETFs to be as tax efficient as traditional ETFs.

- Tax deferral until sold

- No anticipated capital gains distributions to shareholders

- Potential alternative to structured notes or annuities

The creation/redemption process that allows for tax efficiency with Buffer ETFs can be visualized below: