BUFFER ETFS USE OPTIONS TO PURSUE A DEFINED investment outcome. Option prices move in response to movements in the reference asset, but are also sensitive to changes in market volatility and interest rates. The graphs in this chapter show how Buffer ETF prices can move in relation to their reference asset.

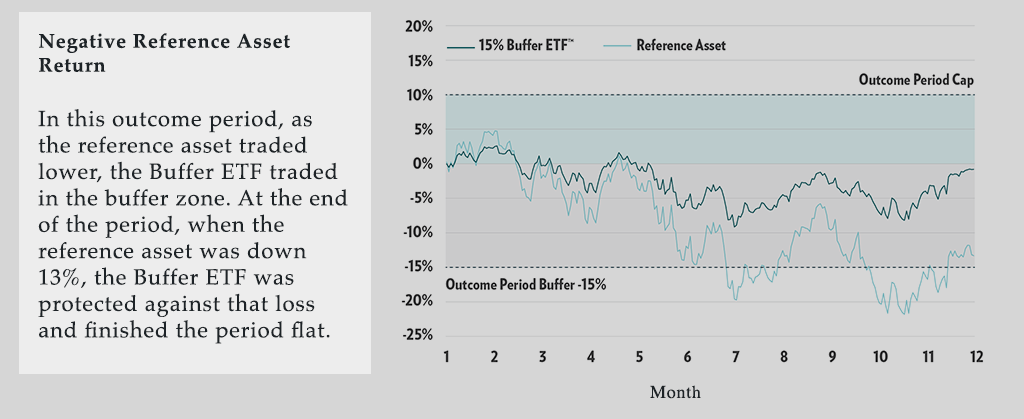

The first graph shows the hypothetical return of an Innovator U.S. Equity Power Buffer ETF relative to the reference asset, the S&P 500 (SPY). The ETF provided downside protection on the first 15% loss in the reference asset. Over the course of the outcome period, the ETF finished down 0.77% while SPY finished down approximately 13%, demonstrating how a built-in buffer can help protect against losses.

Negative Reference Asset Return

In this outcome period, as the reference asset traded lower, the ETF traded in the buffer zone. At the end of the outcome period, when the reference asset was down nearly 13%, the Buffer ETF was protected against the loss and finished the period flat (before fees).

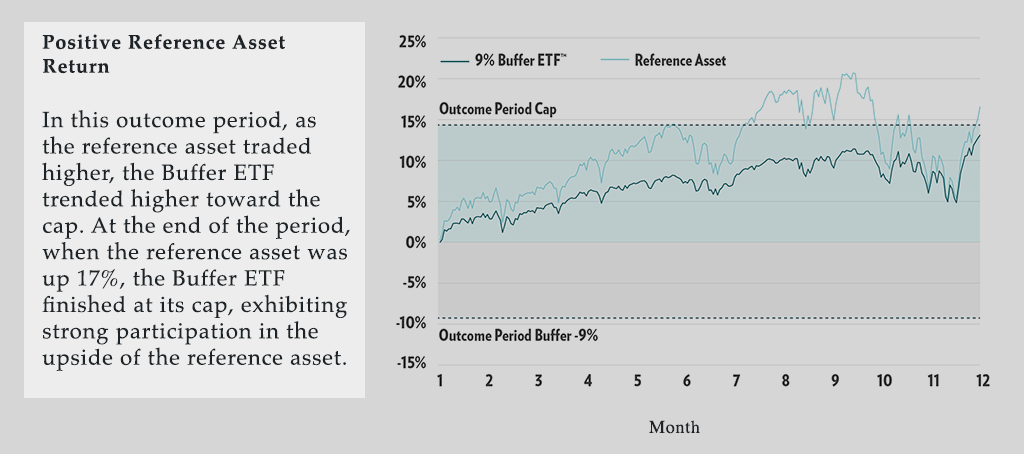

Positive Reference Asset Return

The graph shows the hypothetical return of an Innovator U.S. Equity Buffer ETF relative to the reference asset, the S&P 500 (SPY). The ETF provided protection against the first 9% loss of the reference asset. Over the course of the outcome period, the ETF climbed to its 11.3% cap, while exhibiting less volatility than SPY.

In the outcome period, as the reference asset traded higher, the ETF trended higher toward the cap. At the end of the outcome period, when the reference asset was up 17%, the ETF finished at its cap, participating in the upside of the reference asset, to its cap.