Locking in Profits during the Intra-Outcome Period

Let’s look at an example using PNOV’s (Innovator’s 15% Power Buffer – November) outcome parameters as shown on June 16, 2023. Should an investor consider locking in profits on PNOV, 137 days before the end of the outcome period?

PNOV Defined Outcome Parameters – June 16, 2023

| ETF Ticker | ETF Name | Series | Index Ticker | ETF Price | ETF Return | Index Price | Index Return | Return Difference | Index Return To Cap | Remaining Cap | Down Before Buffer | Remaining Days |

| PNOV | Power Buffer | November | SPY | 33.63 | 12.04% | 439.46 | 13.79% | -1.75% | 5.91% | 7.03% | -11.24% | 137 |

The table shows the potential outcome parameters for PNOV. It offered a very compelling intra-outcome opportunity. PNOV had already gained 12.04% from the most recent reset date – that’s a pretty stellar return over an approximate 7-month period. However, all the gains were unrealized and at risk for the remainder of the outcome period. Obviously, we know that predicting stock market performance over a short time horizon is nearly impossible, so there is a real risk of losing these unrealized profits by the end of the outcome period. What we do know is, if we had purchased PNOV on the prior reset date (October 31, 2022), we had a very attractive unrealized gain that was at risk. Unrealized gains can quickly turn into losses in volatile markets.

A sale of PNOV on June 16 would have protected the 12.04% profit and removed the uncertainty of remaining invested for the balance of the outcome period.

Another reason to have considered a sale of PNOV was the fact that PNOV only offered another 7.03% upside potential (“Remaining Cap”). So, the investor knew the profit potential would be capped at 7.03% over the remaining 137 days. That’s still an attractive return, but not as high as the upside cap of PJUL on its upcoming reset date. By selling PNOV and rotating into PJUL (resets in two weeks on June 30), for example, the investor could lock in profits and create fresh downside protection, with a new higher upside cap (14.28%) over the next 12-month outcome period.

Another alternative strategy would have been to sell PNOV and park the proceeds in Treasury bills over the remainder of PNOV’s outcome period.

PNOV to Cash, then Back to PNOV

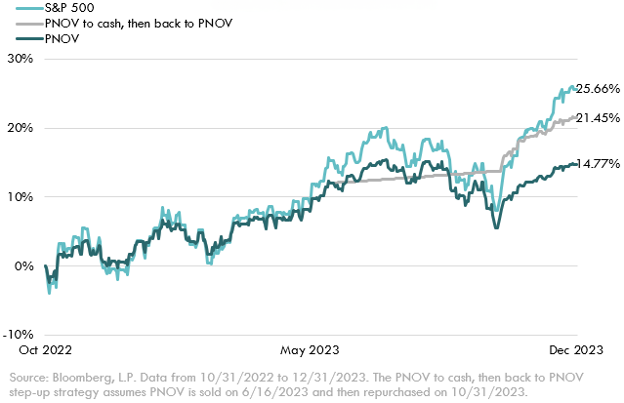

With the benefit of hindsight, a move from PNOV to cash on June 16, and then back to PNOV on October 31, 2023 (the next reset date), would have significantly improved the cumulative percentage gain from October 31, 2022 to December 31, 2023.

In the hypothetical example highlighted in the graph, the investor chose to sell PNOV on June 16 and wait to repurchase it on its next reset date on October 31. It proved to be a highly profitable trade. By repurchasing PNOV on October 31, the investor got a fresh protective buffer and a new upside cap too.

The graph shows a nice visual of how a move from PNOV to cash on June 16, and then back to PNOV on October 31, would have performed relative to the reference asset and compared to a passive PNOV buy-and-hold approach (by the end of 2023).

If an investor had held PNOV from its prior reset date to the end of 2023, the cumulative return would have been 14.77%. If the investor had instead sold PNOV on June 16 and repurchased it on October 31 (on the new reset date), the total cumulative return to the end of 2023 would have been 21.45%, a significant increase in performance. Note, as is clearly shown in the graph, both Buffer ETF strategies lagged the performance of the S&P 500. The buy-and-hold approach of PNOV showed a cumulative return of 14.77%, and the active strategy (sell and repurchase PNOV on the next reset date) showed a return of 21.45%, but the S&P 500 returned 25.66%. Still, a buy-and-hold PNOV strategy would have performed nicely during the outcome period, and a protective sale of PNOV on June 16 and subsequent repurchase on October 31, would have been even more profitable. Note, the S&P 500 will always at least slightly outperform Buffer ETFs in a rising market (fee drag), but an investment in the S&P 500 offers no downside protection whatsoever.

Cumulative Returns: October 31, 2022 – December 31, 2023

PJAN to PSEP Step-Up

The hypothetical graph shows an example of how an investor could have utilized a step-up strategy in 2021. Let’s assume an investor purchased PJAN on the reset date on December 31, 2020. During the subsequent 12-month outcome period, he saw an opportunity to take profits on August 31, 2021 and simultaneously purchased PSEP. He locked in profits with the sale of PJAN and then bought PSEP on the reset date, thus creating a fresh 15% downside buffer and a new upside cap. The improved performance through the end of the year was minimal, but the real advantage was locking in profits early (four months prior to the scheduled reset date for PJAN) and receiving a new buffer and higher upside cap by simultaneously swapping into PSEP.

It’s important to note that unrealized gains in Buffer ETF positions during the intra-outcome period (before the next reset date) are unprotected. The initial investment on the reset date has protection in place (the amount of protection will vary depending on the Buffer series purchased), but any gains that show in Buffer ETFs prior to the next reset date are at risk. For example, a Buffer ETF could show a gain of 10% during the first 8 months of the outcome period, but if the reference asset tumbles the last 4 months of the outcome period, the 10% unrealized profit could evaporate. So again, at times it can be prudent to capture gains before the end of the outcome period.

Obviously, in taxable accounts, an investor must consider the potential tax hit for realizing a taxable gain compared to passively holding PNOV and potentially losing profits during the remainder of the outcome period. Intra-outcome active strategies are much easier to implement in tax-deferred accounts (no IRS reporting of capital gains). Bottom line, by paying attention to the ever-changing outcome parameters of Buffer ETFs, an investor will undoubtedly find some opportunities to lock in profits and potentially improve performance too.

Cumulative Returns: December 31, 2020 – December 31, 2021