Barrier Income ETFs are designed for investors looking for a high level of quarterly income with downside risk management. Most Buffer ETFs do not pay income to investors, so Barrier Income ETFs provide a solution by providing stable income. The high income, along with a built-in downside barrier to protect against losses, should appeal to income-oriented investors. Note, Barrier Income ETF shareholders are subject to all losses if the underlying asset experiences a loss that exceeds the barrier level at the end of the outcome period.

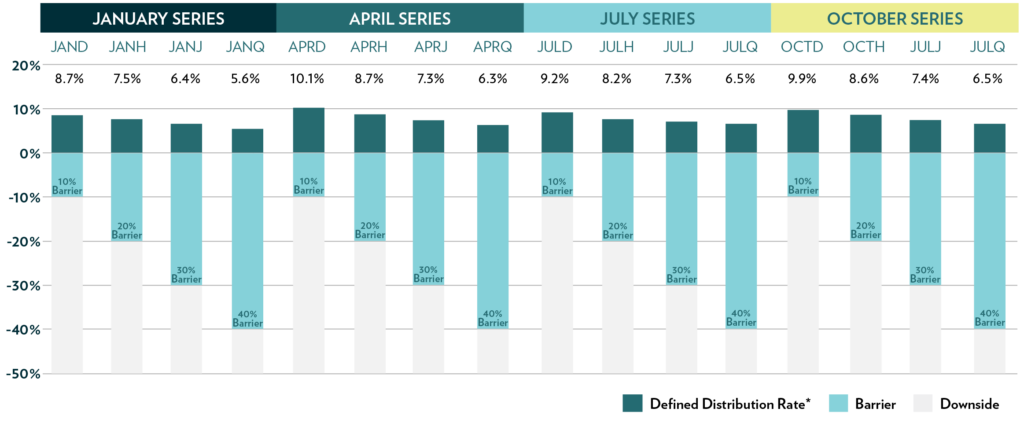

What Barrier Income ETFs are available?

Innovator has four series available, January, April, July and October. And, there are four barrier levels to choose from, 10%, 20%, 30% and 40%. The annual expense ratio is 0.79% and the reference asset is the S&P 500 (SPY).

Why Barrier Income ETFs?

- High level of income

- Defined rate of income over the outcome period

- Built-in risk management

- Four barrier levels to choose from depending on your risk profile

- Cost effective, flexible, liquid and transparent

- No bank credit risk

- Rebalance annually and can be held indefinitely

Barrier Income ETF Defined Distribution Rates

Source: Bloomberg, as of 12/31/2023. The Barrier ETF distribution rate, established at the commencement of each Outcome Period, is an annualized payment rate that is achievable through the premium received from sold option contracts (as described further below) and the Fund’s investments in U.S. Treasuries. The Distribution Rate is not guaranteed.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see “Investor Suitability” in the prospectus.

The Defined Distribution Rate is shown prior to taking into account fees charged to shareholders, which have the result of a lower distribution. The Funds differ from other funds that utilize a defined outcome investment strategy. The Funds do not provide a buffer against all underlying ETF losses or a floor that provides a maximum amount of Underlying ETF losses. As a result, an investor can lose his entire investment prior to consideration of any Defined Distribution payments.

How do Barrier Income ETFs work?

Barrier Income ETFs pursue a high level of income by selling options on the S&P 500 (SPY). The result is a strategy that seeks to offer meaningful return potential in both positive and negative markets.

Understanding your experience with Barrier Income ETFs

Potential Outcome Scenarios

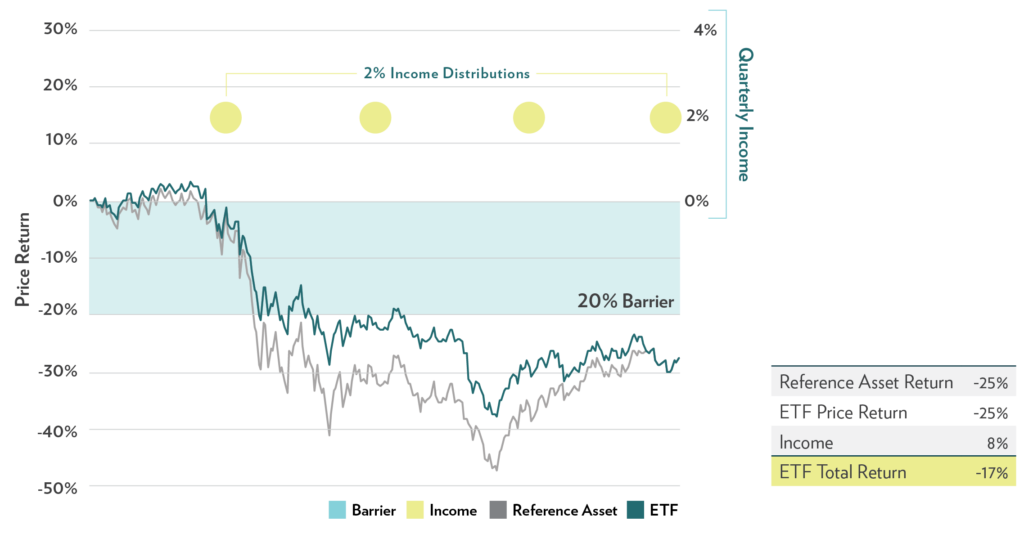

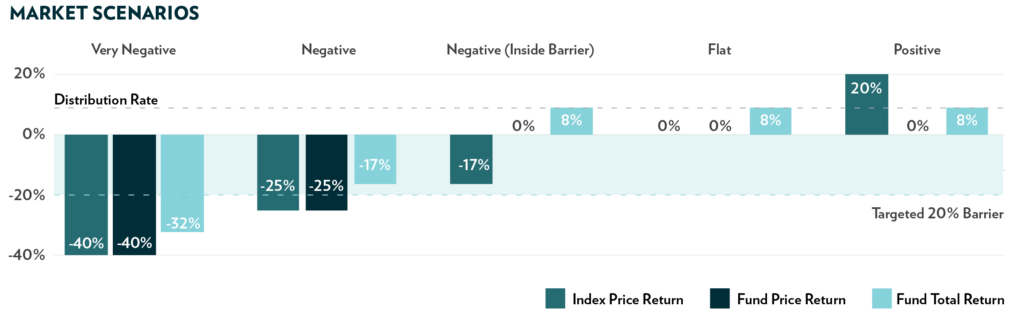

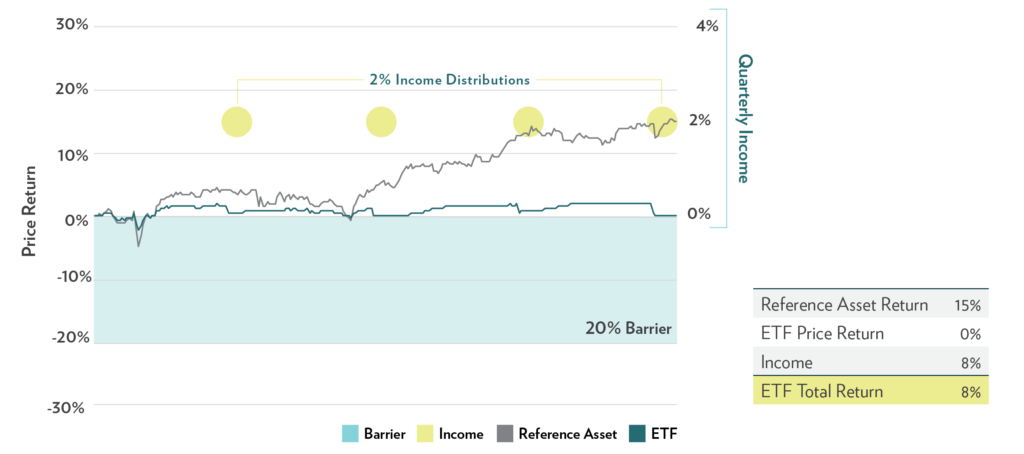

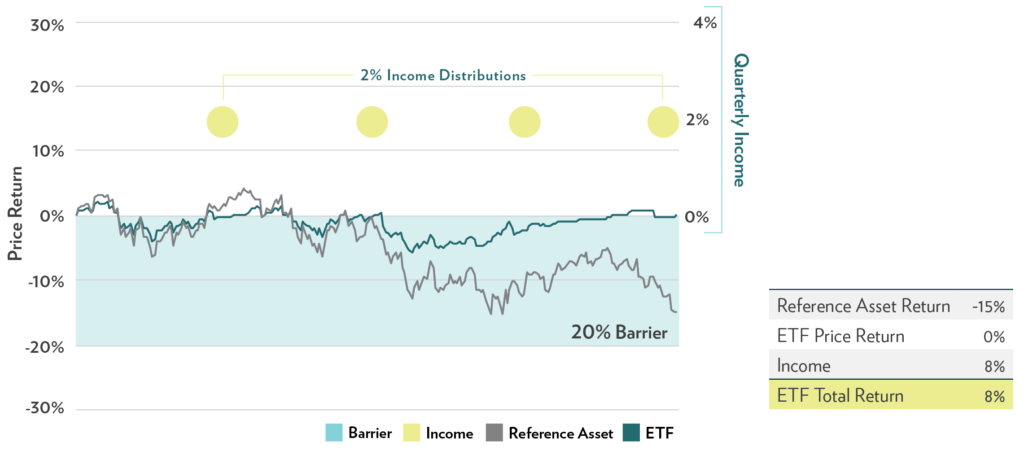

Selling the options creates exposure to the index at levels below the chosen barrier, over the full outcome period. The hypothetical chart below uses the 20% barrier as an example of what investors can expect across different market return scenarios. The annual distribution rate is 8% (quarterly payments).

Scenario 1: Reference asset increases

As the market trades up, the ETF remains near its starting price. At the end of the outcome period, the NAV of the ETF equals the NAV from day one. The investor receives all four income distributions.

Scenario 2: Reference asset decreases, but finishes above the barrier level

As the market trades down, the ETF declines to a lesser extent. At the end of the outcome period, the NAV of the ETF equals the NAV from day one. The investor receives all four income distributions.

Scenario 3: Reference asset decreases and finishes below the barrier level

As the market trades down, the ETF also declines. Since the reference asset breached the 25% barrier level at the end of the outcome period, the ETF price return matches the performance of the reference asset, -25%. The investor receives all four income distributions (8%) for a total return of -17%.