BUFFER ETFS ARE ONE OF THE FASTEST growing segments of the ETF marketplace. Assets have grown from $200 million in 2018 to over $35 billion in 2024, and there are now over 160 Buffer ETFs trading on U.S. markets. Buffer ETFs are also sometimes referred to as Defined Outcome ETFs, Target Outcome ETFs or Buffered ETFs, but they are all essentially the same investment vehicles. These ETFs track a stock market index over a defined outcome period, while offering downside protection, known as a “buffer.” Investors can also participate in the upside of the stock market, to a predetermined cap.

Typically, the “buffer” protects against the first loss of 9%, 10%, 12%, 15%, or 20%, depending on the Buffer series you own. You can customize your portfolio and choose your desired buffer level over the outcome period, which is typically 12 months. There are also Buffer ETFs that reset quarterly or semi-annually.

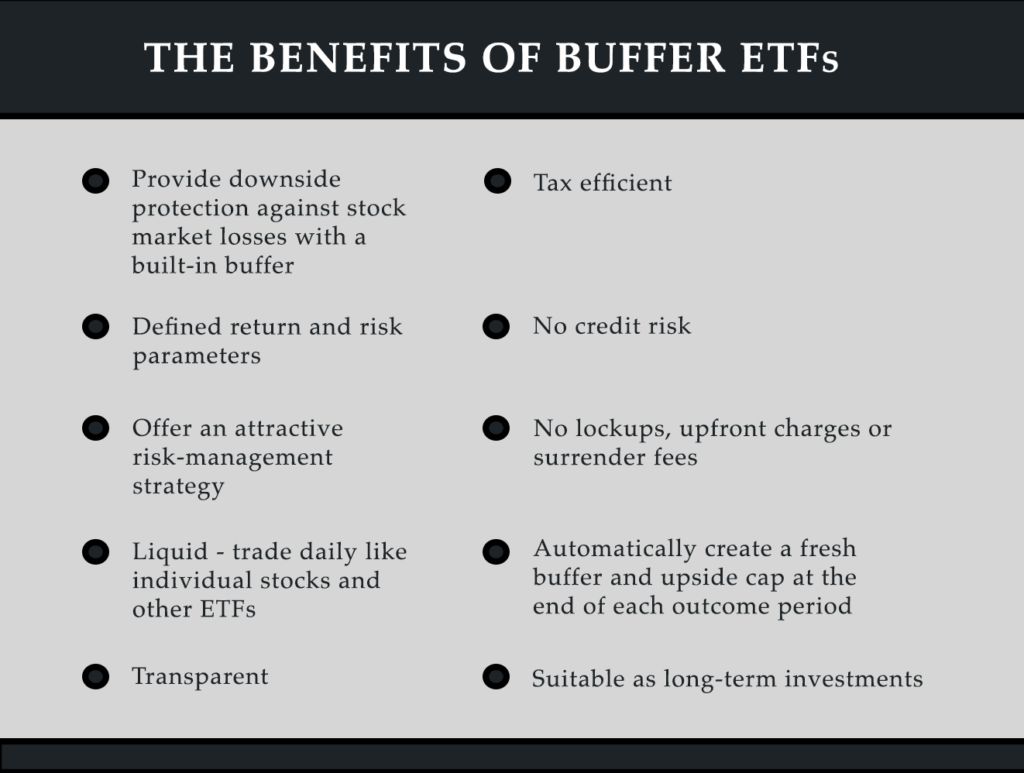

Buffer ETFs don’t actually own stocks. They use options to track the performance of a major stock market index (e.g., S&P 500, Nasdaq 100, emerging markets, international) to a cap, with built-in downside protection. Historically, defined outcome investments have only been available through certain banks and insurance companies. Now, you can invest in these strategies with a benefit-rich ETF wrapper.