For investors who like the idea of opportunistically investing in defined outcomes, but don’t have the interest or time to continually monitor and evaluate a full lineup of Buffer ETFs, Managed Buffer Step-Up Strategy ETFs provide an attractive option.

Managed Buffer Step-Up ETFs are designed to have the potential to outperform a static buffer strategy by evaluating each month for opportunities to “step-up.” BSTP pursues a 9% buffer while PSTP seeks a 15% buffer. Both ETFs are offered by Innovator. The strategies are designed to allow investors to participate in a step-up strategy without having to actively manage a Buffer ETF portfolio.

Managed Outcome Strategies offer the following features and advantages:

Features

Built-in buffers

Risk-managed

Reduced cap-timing risk

Smoother overall investment experience

Historically lower volatility relative to the S&P 500

Potential for outperformance

Tax-efficient rotation

Actively managed

Rules-based

Easy to implement

Advantages

Single-ticker managed-buffer solution

Exposure to the S&P 500 (SPY), subject to a potential limit

Cost effective, flexible, liquid, and transparent

Tax-efficient

No credit risk

Rebalances periodically and can be held indefinitely

How do Step-Up Strategies work?

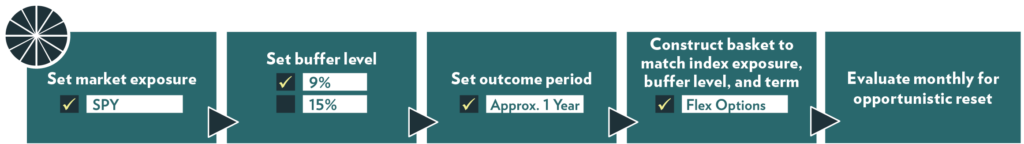

Step-Up ETFs begin with a one-year options portfolio. At each monthly portfolio evaluation, if a step-up threshold has not been met, the portfolio remains unchanged. If a step-up threshold has been met, the fund will roll into a new one-year option portfolio with a fresh buffer and new upside cap.

Step-Up Methodology

The Step-Up Methodology works as follows:

Two business days prior to the end of month: The portfolio is evaluated to determine if a Buffer ETF has met the up or down threshold.

Last business day of the month: The ETF sells the current options portfolio and purchases a new options package.

First business day of next month: The ETF has a new one-year options portfolio with a fresh buffer and new upside cap.

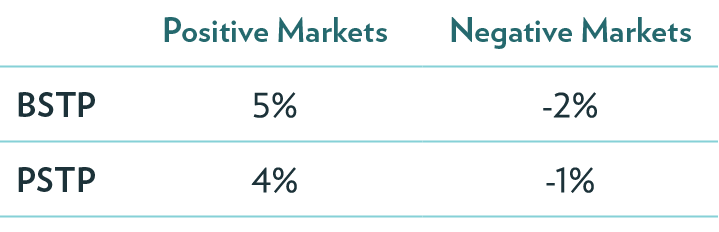

Current Thresholds

Strategy Response Across Different Market Scenarios

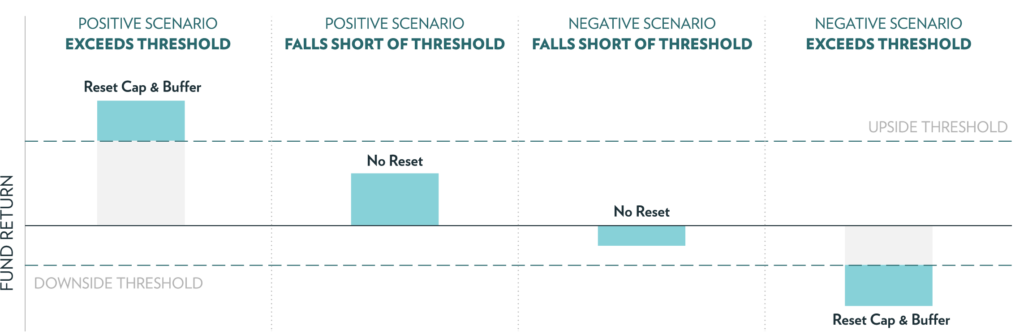

Objectives:

Seek to lock in gains

Potentially increase upside

Obtain a fresh downside buffer

Eliminate downside-before-buffer risk

Potential Benefits of Step-Up ETFs

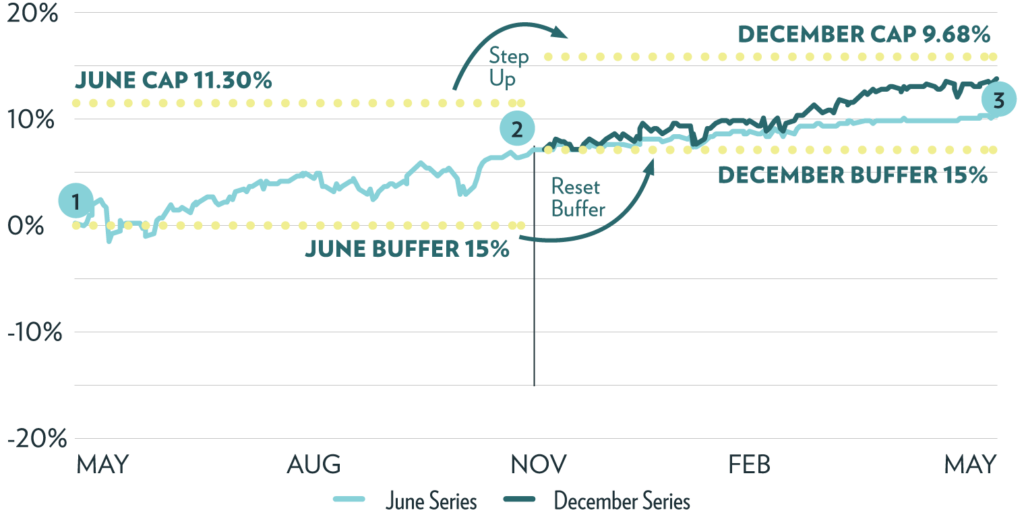

1) Capture gains and potentially mitigate down-before-buffer risk: When the value of the ETF has increased, stepping up to the new month locks in the gain and resets the buffer.

This hypothetical graphical illustration provided above is designed to illustrate the Outcomes based upon the hypothetical performances of the Underlying ETF for investors who hold Shares for the entirety of the Outcome Period and does not provide every possible performance scenario. The returns that the Fund seeks to provide do not include costs associated with purchasing Shares and certain expenses incurred by the Fund. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes.

“Cap” refers to the maximum potential return, before fees and expenses and any shareholder transaction fees and any extraordinary expenses, if held over the full Outcome Period. “Buffer” refers to the amount of downside protection the Fund seeks to provide, before fees and expenses, over the full Outcome Period. Outcome Period is the intended length of time over which the defined outcomes are sought.

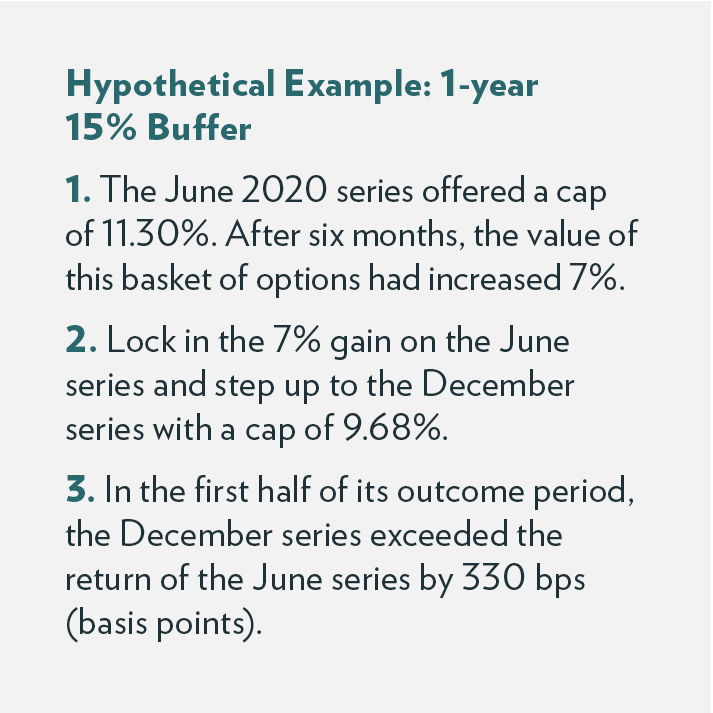

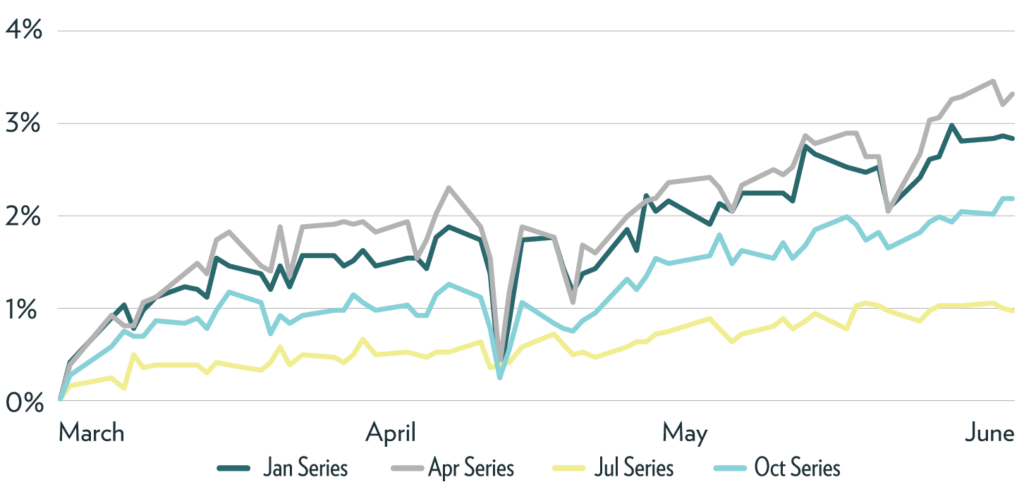

2) Seek to take advantage of return dispersions: As a Buffer ETF gets closer to its cap, it has less upside potential and becomes less sensitive to increases in the value of the reference asset. A Step-Up ETF has the potential to create increased upside by moving to a higher cap and by increasing the portfolio’s sensitivity to upward moves in the reference asset.

Return dispersions create opportunities to rotate: In the chart below each ETF has a 15% buffer and SPY is the reference asset, but each exhibits its own level of sensitivity to the reference asset.

Performance Can Vary Across Monthly Series of Buffer ETFs

Performance quoted represents past performance, which is no guarantee of future results. Investment returns and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than quoted.

Managed Buffer Step-Up Strategy ETFs to consider:

Managed Step-Up Strategy 9% Buffer – BSTP

The Innovator Buffer Step-Up Strategy ETF (9% Buffer) is an actively-managed ETF that seeks to provide risk-managed exposure to the SPDR S&P 500 ETF Trust (SPY). The ETF is a one-ticker solution designed to offer an opportunistically-managed buffer strategy. The ETF is evaluated monthly and can be held indefinitely.

At each monthly portfolio evaluation, if a step-up threshold has not been met, the portfolio remains unchanged. If a step-up threshold has been met, the fund will roll into a new one-year options portfolio with a fresh buffer and new upside cap.

Managed Step-Up Strategy 15% Buffer – PSTP

The Innovator Power Buffer Step-Up Strategy ETF (15% Buffer) is an actively-managed ETF that seeks to provide risk-managed exposure to the SPDR S&P 500 ETF Trust (SPY). The ETF is a one-ticker solution designed to offer an opportunistically-managed buffer strategy. The ETF is evaluated monthly and can be held indefinitely.

At each monthly portfolio evaluation, if a step-up threshold has not been met, the portfolio remains unchanged. If a step-up threshold has been met, the ETF will roll into a new one-year options portfolio with a fresh buffer and new upside cap. Note, while Managed Buffer ETFs seek to provide reduced cap timing risk, a smoother overall investment experience, lower volatility, and the potential to outperform a static Buffer strategy, Managed Buffer ETFs do not offer investors a defined outcome.